The Economics of the Civil War

Roger L. Ransom, University of California, Riverside

The Civil War has been something of an enigma for scholars studying American history. During the first half of the twentieth century, historians viewed the war as a major turning point in American economic history. Charles Beard labeled it "Second American Revolution," claiming that "at bottom the so-called Civil War ? was a social war, ending in the unquestioned establishment of a new power in the government, making vast changes ? in the course of industrial development, and in the constitution inherited from the Fathers" (Beard and Beard 1927: 53). By the time of the Second World War, Louis Hacker could sum up Beard's position by simply stating that the war's "striking achievement was the triumph of industrial capitalism" (Hacker 1940: 373). The "Beard-Hacker Thesis" had become the most widely accepted interpretation of the economic impact of the Civil War. Harold Faulkner devoted two chapters to a discussion of the causes and consequences of the war in his 1943 textbook American Economic History (which was then in its fifth edition), claiming that "its effects upon our industrial, financial, and commercial history were profound" (1943: 340).

In the years after World War II, a new group of economic historians -- many of them trained in economics departments -- focused their energies on the explanation of economic growth and development in the United States. As they looked for the keys to American growth in the nineteenth century, these economic historians questioned whether the Civil War -- with its enormous destruction and disruption of society -- could have been a stimulus to industrialization. In his 1955 textbook on American economic history, Ross Robertson mirrored a new view of the Civil War and economic growth when he argued that "persistent, fundamental forces were at work to forge the economic system and not even the catastrophe of internecine strife could greatly affect the outcome" (1955: 249). "Except for those with a particular interest in the economics of war," claimed Robertson, "the four year period of conflict [1861-65] has had little attraction for economic historians" (1955: 247). Over the next two decades, this became the dominant view of the Civil War's role industrialization of the United States.

Historical research has a way of returning to the same problems over and over. The efforts to explain regional patterns of economic growth and the timing of the United States' "take-off" into industrialization, together with extensive research into the "economics" of the slave system of the South and the impact of emancipation, brought economic historians back to questions dealing with the Civil War. By the 1990s a new generation of economic history textbooks once again examined the "economics" of the Civil War (Atack and Passell 1994; Hughes and Cain 1998; Walton and Rockoff 1998). This reconsideration of the Civil War by economic historians can be loosely grouped into four broad issues: the "economic" causes of the war; the "costs" of the war; the problem of financing the War; and a re-examination of the Hacker-Beard thesis that the War was a turning point in American economic history.

Economic Causes of the War

No one seriously doubts that the enormous economic stake the South had in its slave labor force was a major factor in the sectional disputes that erupted in the middle of the nineteenth century. Figure 1 plots the total value of all slaves in the United States from 1805 to 1860. In 1805 there were just over one million slaves worth about $300 million; fifty-five years later there were four million slaves worth close to $3 billion. In the 11 states that eventually formed the Confederacy, four out of ten people were slaves in 1860, and these people accounted for more than half the agricultural labor in those states. In the cotton regions the importance of slave labor was even greater. The value of capital invested in slaves roughly equaled the total value of all farmland and farm buildings in the South. Though the value of slaves fluctuated from year to year, there was no prolonged period during which the value of the slaves owned in the United States did not increase markedly. Looking at Figure 1, it is hardly surprising that Southern slaveowners in 1860 were optimistic about the economic future of their region. They were, after all, in the midst of an unparalleled rise in the value of their slave assets.

A major finding of the research into the economic dynamics of the slave system was to demonstrate that the rise in the value of slaves was not based upon unfounded speculation. Slave labor was the foundation of a prosperous economic system in the South. To illustrate just how important slaves were to that prosperity, Gerald Gunderson (1974) estimated what fraction of the income of a white person living in the South of 1860 was derived from the earnings of slaves. Table 1 presents Gunderson's estimates. In the seven states where most of the cotton was grown, almost one-half the population were slaves, and they accounted for 31 percent of white people's income; for all 11 Confederate States, slaves represented 38 percent of the population and contributed 23 percent of whites' income. Small wonder that Southerners -- even those who did not own slaves -- viewed any attempt by the federal government to limit the rights of slaveowners over their property as a potentially catastrophic threat to their entire economic system. By itself, the South's economic investment in slavery could easily explain the willingness of Southerners to risk war when faced with what they viewed as a serious threat to their "peculiar institution" after the electoral victories of the Republican Party and President Abraham Lincoln the fall of 1860.

|

Table 1 The Fraction of Whites' Incomes from Slavery

|

||||

|

State |

Percent of the Population That Were Slaves |

Per Capita Earnings of Free Whites (in dollars) |

Slave Earnings per Free White (in dollars) |

Fraction of Earnings Due to Slavery |

|

Alabama |

45 |

120 |

50 |

41.7 |

|

South Carolina |

57 |

159 |

57 |

35.8 |

|

Florida |

44 |

143 |

48 |

33.6 |

|

Georgia |

44 |

136 |

40 |

29.4 |

|

Mississippi |

55 |

253 |

74 |

29.2 |

|

Louisiana |

47 |

229 |

54 |

23.6 |

|

Texas |

30 |

134 |

26 |

19.4 |

|

Seven Cotton States |

46 |

163 |

50 |

30.6 |

|

North Carolina |

33 |

108 |

21 |

19.4 |

|

Tennessee |

25 |

93 |

17 |

18.3 |

|

Arkansas |

26 |

121 |

21 |

17.4 |

|

Virginia |

32 |

121 |

21 |

17.4 |

|

|

|

|

|

|

|

All 11 States |

38 |

135 |

35 |

25.9 |

|

Source: Computed from data in Gerald Gunderson (1974: 922, Table 1) |

||||

The Northern states also had a huge economic stake in slavery and the cotton trade. The first half of the nineteenth century witnessed an enormous increase in the production of short-staple cotton in the South, and most of that cotton was exported to Great Britain and Europe. Figure 2 charts the growth of cotton exports from 1815 to 1860. By the mid 1830s, cotton shipments accounted for more than half the value of all exports from the United States. Note that there is a marked similarity between the trends in the export of cotton and the rising value of the slave population depicted in Figure 1. There could be little doubt that the prosperity of the slave economy rested on its ability to produce cotton more efficiently than any other region of the world.

The income generated by this "export sector" was a major impetus for growth not only in the South, but in the rest of the economy as well. Douglass North, in his pioneering study of the antebellum U.S. economy, examined the flows of trade within the United States to demonstrate how all regions benefited from the South's concentration on cotton production (North 1961). Northern merchants gained from Southern demands for shipping cotton to markets abroad, and from the demand by Southerners for Northern and imported consumption goods. The low price of raw cotton produced by slave labor in the American South enabled textile manufacturers -- both in the United States and in Britain -- to expand production and provide benefits to consumers through a declining cost of textile products. As manufacturing of all kinds expanded at home and abroad, the need for food in cities created markets for foodstuffs that could be produced in the areas north of the Ohio River. And the primary force at work was the economic stimulus from the export of Southern Cotton. When James Hammond exclaimed in 1859 that "Cotton is King!" no one rose to dispute the point.

With so much to lose on both sides of the Mason-Dixon Line, economic logic suggests that a peaceful solution to the slave issue would have made far more sense than a bloody war. Yet no solution emerged. One "economic" solution to the slave problem would be for those who objected to slavery to "buy out" the economic interest of Southern slaveholders. Under such a scheme, the federal government would purchase slaves. A major problem here was that the costs of such a scheme would have been enormous. Claudia Goldin estimates that the cost of having the government buy all the slaves in the United States in 1860, would be about $2.7 billion (1973: 85, Table 1). Obviously, such a large sum could not be paid all at once. Yet even if the payments were spread over 25 years, the annual costs of such a scheme would involve a tripling of federal government outlays (Ransom and Sutch 1990: 39-42)! The costs could be reduced substantially if instead of freeing all the slaves at once, children were left in bondage until the age of 18 or 21 (Goldin 1973:85). Yet there would remain the problem of how even those reduced costs could be distributed among various groups in the population. The cost of any "compensated" emancipation scheme was so high that even those who wished to eliminate slavery were unwilling to pay for a "buyout" of those who owned slaves.

The high cost of emancipation was not the only way in which economic forces produced strong regional tensions in the United States before 1860. The regional economic specialization, previously noted as an important cause of the economic expansion of the antebellum period, also generated very strong regional divisions on economic issues. Recent research by economic, social and political historians has reopened some of the arguments first put forward by Beard and Hacker that economic changes in the Northern states were a major factor leading to the political collapse of the 1850s. Beard and Hacker focused on the narrow economic aspects of these changes, interpreting them as the efforts of an emerging class of industrial capitalists to gain control of economic policy. More recently, historians have taken a broader view of the situation, arguing that the sectional splits on these economic issues reflected sweeping economic and social changes in the Northern and Western states that were not experienced by people in the South. The term most historians have used to describe these changes is a "market revolution."

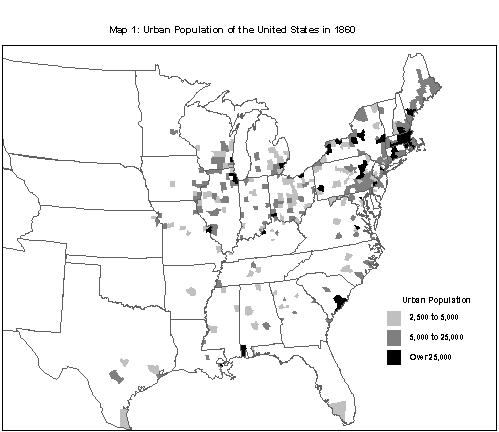

Source: United States Population Census, 1860.

Perhaps the best single indicator of how pervasive the "market revolution" was in the Northern and Western states is the rise of urban areas in areas where markets have become important. Map 1 plots the 292 counties that reported an "urban population" in 1860. (The 1860 Census Office defined an "urban place" as a town or city having a population of at least 2,500 people.) Table 2 presents some additional statistics on urbanization by region. In 1860 6.1 million people -- roughly one out of five persons in the United States -- lived in an urban county. A glance at either the map or Table 2 reveals the enormous difference in urban development in the South compared to the Northern states. More than two-thirds of all urban counties were in the Northeast and West; those two regions accounted for nearly 80 percent of the urban population of the country. By contrast, less than 7 percent of people in the 11 Southern states of Table 2 lived in urban counties.

|

Table 2 Urban Population of the United States in 1860a

|

||||

|

Region |

Counties with Urban Populations |

Total Urban Population in the Region |

Percent of Region's Population Living in Urban Counties |

Region's Urban Population as Percent of U.S. Urban Population |

|

Northeastb |

103 |

3,787,337 |

35.75 |

61.66 |

|

Westc |

108 |

1,059,755 |

13.45 |

17.25 |

|

Borderd |

23 |

578,669 |

18.45 |

9.42 |

|

Southe |

51 |

621,757 |

6.83 |

10.12 |

|

Far Westf |

7 |

99,145 |

15.19 |

1.54 |

|

Totalg |

292 |

6,141,914 |

19.77 |

100.00 |

|

Notes: a Urban population is people living in a city or town of at least 2,500 b Includes: Connecticut, Maine, Massachusetts, New Hampshire, New Jersey, New York, Pennsylvania, Rhode Island, and Vermont. c Includes: Illinois, Indiana, Iowa, Kansas, Minnesota, Nebraska, Ohio, and Wisconsin. d Includes: Delaware, Kentucky, Maryland, and Missouri. e Includes: Alabama, Arkansas, Florida, Georgia, Louisiana, Mississippi, North Carolina, South Carolina, Tennessee, Texas, and Virginia. f Includes: Colorado, California, Dakotas, Nevada, New Mexico, Oregon, Utah and Washington g includes District of Columbia Source: U.S Census of Population, 1860. |

||||

The region along the north Atlantic Coast, with its extensive development of commerce and industry, had the largest concentration of urban population in the United States; roughly one-third of the population of the nine states defined as the Northeast in Table 2 lived in urban counties. In the South, the picture was very different. Cotton cultivation with slave labor did not require local financial services or nearby manufacturing activities that might generate urban activities. The 11 states of the Confederacy had only 51 urban counties and they were widely scattered throughout the region. Western agriculture with its emphasis on foodstuffs encouraged urban activity near to the source of production. These centers were not necessarily large; indeed, the West had roughly the same number of large and mid-sized cities as the South. However there were far more small towns scattered throughout settled regions of Ohio, Indiana, Illinois, Wisconsin and Michigan than in the Southern landscape.

Economic policy had played a prominent role in American politics since the birth of the republic in 1790. With the formation of the Whig Party in the 1830s, a number of key economic issues emerged at the national level. To illustrate the extent to which the rise of urban centers and increased market activity in the North led to a growing crisis in economic policy, historians have re-examined four specific areas of legislative action singled out by Beard and Hacker as evidence of a Congressional stalemate in 1860 (Egnal 2001; Ransom and Sutch 2001; 1989; Bensel 1990; McPherson 1988).

Land Policy

1. Land Policy. Settlement of western lands had always been a major bone of contention for slave and free-labor farms. The manner in which the federal government distributed land to people could have a major impact on the nature of farming in a region. Northerners wanted to encourage the settlement of farms which would depend primarily on family labor by offering cheap land in small parcels. Southerners feared that such a policy would make it more difficult to keep areas open for settlement by slaveholders who wanted to establish large plantations. This all came to a head with the "Homestead Act" of 1860 that would provide 160 acres of free land for anyone who wanted to settle and farm the land. Northern and western congressmen strongly favored the bill in the House of Representatives but the measure received only a single vote from slave states' representatives. The bill passed, but President Buchanan vetoed it. (Bensel 1990: 69-72)

Transportation Improvements

2. Transportation Improvements. Following the opening of the Erie Canal in 1823, there was growing support in the North and the Northwest for government support of improvement in transportation facilities -- what were termed in those days "internal improvements". The need for government- sponsored improvements was particularly urgent in the Great Lakes region (Egnal 2001: 45-50). The appearance of the railroad in the 1840s gave added support for those advocating government subsidies to promote transportation. Southerners required far fewer internal improvements than people in the Northwest, and they tended to view federal subsidies for such projects to be part of a "deal" between western and eastern interests that held no obvious gains for the South. The bill that best illustrates the regional disputes on transportation was the Pacific Railway Bill of 1860, which proposed a transcontinental railway link to the West Coast. The bill failed to pass the House, receiving no votes from congressmen representing districts of the South where there was a significant slave population (Bensel 1990: 70-71).

The Tariff

3. The Tariff. Southerners, with their emphasis on staple agriculture and need to buy goods produced outside the South, strongly objected to the imposition of duties on imported goods. Manufacturers in the Northeast, on the other hand, supported a high tariff as protection against cheap British imports. People in the West were caught in the middle of this controversy. Like the agricultural South they disliked the idea of a high "protective" tariff that raised the cost of imports. However the tariff was also the main source of federal revenue at this time, and Westerners needed government funds for the transportation improvements they supported in Congress. As a result, a compromise reached by western and eastern interests during in the tariff debates of 1857 was to support a "moderate" tariff; with duties set high enough to generate revenue and offer some protection to Northern manufacturers while not putting too much of a burden on Western and Eastern consumers. Southerners complained that even this level of protection was excessive and that it was one more example of the willingness of the West and the North to make economic bargains at the expense of the South (Ransom and Sutch 2001; Egnal 2001:50-52).

Banking

4. Banking. The federal government's role in the chartering and regulation of banks was a volatile political issue throughout the antebellum period. In 1834 President Andrew Jackson created a major furor when he vetoed a bill to recharter the Second Bank of the United States. Jackson's veto ushered in a period of that was termed "free banking" in the United States, where the chartering and regulation of banks was left entirely in the hands of state governments. Banks were a relatively new economic institution at this point in time, and opinions were sharply divided over the degree to which the federal government should regulate banks. In the Northeast, where over 60 percent of all banks were located, there was strong support by 1860 for the creation of a system of banks that would be chartered and regulated by the federal government. But in the South, which had little need for local banking services, there was little enthusiasm for such a proposal. Here again, the western states were caught in the middle. While they worried that a system of "national" banks that would be controlled by the already dominant eastern banking establishment, western farmers found themselves in need of local banking services for financing their crops. By 1860 many were inclined to support the Republican proposal for a National Banking System, however Southern opposition killed the National Bank Bill in 1860 (Ransom and Sutch 2001; Bensel 1990).

The growth of an urbanized market society in the North produced more than just a legislative program of political economy that Southerners strongly resisted. Several historians have taken a much broader view of the market revolution and industrialization in the North. They see the economic conflict of North and South, in the words of Richard Brown, as "the conflict of a modernizing society" (1976: 161). A leading historian of the Civil War, James McPherson, argues that Southerners were correct when they claimed that the revolutionary program sweeping through the North threatened their way of life (1983; 1988). James Huston (1999) carries the argument one step further by arguing that Southerners were correct in their fears that the triumph of this coalition would eventually lead to an assault by Northern politicians on slave property rights.

All this provided ample argument for those clamoring for the South to leave the Union in 1861. But why did the North fight a war rather than simply letting the unhappy Southerners go in peace? It seems unlikely that anyone will ever be able to show that the "gains" from the war outweighed the "costs" in economic terms. Still, war is always a gamble, and with the neither the costs nor the benefits easily calculated before the fact, leaders are often tempted to take the risk. The evidence above certainly lent strong support for those arguing that it made sense for the South to fight if a belligerent North threatened the institution of slavery. An economic case for the North is more problematic. Most writers argue that the decision for war on Lincoln's part was not based primarily on economic grounds. However, Gerald Gunderson points out that if, as many historians argue, Northern Republicans were intent on controlling the spread of slavery, then a war to keep the South in the Union might have made sense. Gunderson compares the "costs" of the war (which we discuss below) with the cost of "compensated" emancipation and notes that the two are roughly the same order of magnitude -- 2.5 to 3.7 billion dollars (1974: 940-42). Thus, going to war made as much "economic sense" as buying out the slaveholders. Gunderson makes the further point, which has been echoed by other writers, that the only way that the North could ensure that their program to contain slavery could be "enforced" would be if the South were kept in the Union. Allowing the South to leave the Union would mean that the North could no longer control the expansion of slavery anywhere in the Western Hemisphere (Ransom 1989; Ransom and Sutch 2001; Weingast 1998; Weingast 1995; Wolfson 1995). What is novel about these interpretations of the war is that they argue it was economic pressures of "modernization" in the North that made Northern policy towards secession in 1861 far more aggressive than the traditional story of a North forced into military action by the South's attack on Fort Sumter.

That is not to say that either side wanted war -- for economic or any other reason. Abraham Lincoln probably summarized the situation as well as anyone when he observed in his second inaugural address that: "Both parties deprecated war, but one of them would make war rather than let the nation survive, and the other would accept war rather than let it perish, and the war came."

The "Costs" of the War

The Civil War has often been called the first "modern" war. In part this reflects the enormous effort expended by both sides to conduct the war. What was the cost of this conflict? The most comprehensive effort to answer this question is the work of Claudia Goldin and Frank Lewis (1978; 1975). The Goldin and Lewis estimates of the costs of the war are presented in Table 3. The costs are divided into two groups: the direct costs which include the expenditures of state and local governments plus the loss from destruction of property and the loss of human capital from the casualties; and what Goldin and Lewis term the indirect costs of the war which include the subsequent implications of the war after 1865. Goldin and Lewis estimate that the combined outlays of both governments -- in 1860 dollars -- totaled $3.3 billion. To this they add $1.8 billion to account for the discounted economic value of casualties in the war, and they add $1.5 billion to account for the destruction of the war in the South. This gives a total of $6.6 billion in direct costs -- with each region incurring roughly half the total.

Table 3The

Costs of the Civil War (Millions

of 1860 Dollars) |

|||

|

|

South |

North |

Total |

|

Direct

Costs: |

|

|

|

|

Government Expenditures |

1,032 |

2,302 |

3,334 |

|

Physical Destruction |

1,487 |

|

1,487 |

|

Loss of Human Capital |

767 |

1,064 |

1,831 |

|

|

|

|

|

|

Total

Direct Costs of the War |

3,286 |

3,366 |

6,652 |

|

Per capita |

376 |

148 |

212 |

|

Indirect

Costs: |

|

|

|

|

Total Decline in Consumption |

6,190 |

1,149 |

7,339 |

|

Less: |

|

|

|

|

Effect of Emancipation |

1,960 |

|

|

|

Effect of Cotton Prices |

1,670 |

|

|

|

|

|

|

|

|

Total

Indirect Costs of The War |

2,560 |

1,149 |

3,709 |

|

Per capita |

293 |

51 |

118 |

|

Total

Costs of the War |

5,846 |

4,515 |

10,361 |

|

Per capita |

670 |

199 |

330 |

|

|

|

|

|

|

Population

in 1860 (Million) |

8.73 |

27.71 |

31.43 |

|

Source:

Ransom, (1998: 51, Table 3-1); Goldin and Lewis. (1975; 1978) |

|||

While these figures are only a very rough estimate of the actual costs, they provide an educated guess as to the order of magnitude of the economic effort required to wage the war, and it seems likely that if there is a bias, it is to understate the total. (Thus, for example, the estimated "economic" losses from casualties ignore the emotional cost of 625,000 deaths, and the estimates of property destruction were quite conservative.) Even so, the direct cost of the war as calculated by Goldin and Lewis was 1.5 times the total gross national product of the United States for 1860 -- an enormous sum in comparison with any military effort by the United States up to that point. What stands out in addition to the enormity of the bill is the disparity in the burden these costs represented to the people in the North and the South. On a per capita basis, the costs to the North population were about $150 -- or roughly equal to one year's income. The Southern burden was two and a half times that amount -- $376 per man, woman and child.

Staggering though these numbers are, they represent only a fraction of the full costs of the war, which lingered long after the fighting had stopped. One way to measure the full "costs" and "benefits" of the war, Goldin and Lewis argue, is to estimate the value of the observed postwar stream of consumption in each region and compare that figure to the estimated hypothetical stream of consumption had there been no war (1975: 309-10). (All the figures for the costs in Table 3 have been adjusted to reflect their discounted value in 1860.) The Goldin and Lewis estimate for the discounted value of lost consumption for the South was $6.2 billion; for the North the estimate was $1.15 billion. Ingenious though this methodology is, it suffers from the serious drawback that consumption lost for any reason -- not just the war -- is included in the figure. Particularly for the South, not all the decline in output after 1860 could be directly attributed to the war; the growth in the demand for cotton that fueled the antebellum economy did not continue, and there was a dramatic change in the supply of labor due to emancipation. Consequently, Goldin and Lewis subsequently adjusted their estimate of lost consumption due to the war down to $2.56 billion for the South in order to exclude the effects of emancipation and the collapse of the cotton market. The magnitudes of the indirect effects are detailed in Table 3. After the adjustments, the estimated costs for the war totaled more than $10 billion. Allocating the costs to each region produces a per capita burden of $670 in the South and $199 in the North. What Table 3 does not show is the extent to which these expenses were spread out over a long period of time. In the North, consumption had regained its prewar level by 1873, however in the South consumption remained below its 1860 level to the end of the century. We shall return to this issue below.

Financing the War

No war in American history strained the economic resources of the economy as the Civil War did. Governments on both sides were forced to resort to borrowing on an unprecedented scale to meet the financial obligations for the war. With more developed markets and an industrial base that could ultimately produce the goods needed for the war, the Union was clearly in a better position to meet this challenge. The South, on the other hand, had always relied on either Northern or foreign capital markets for their financial needs, and they had virtually no manufacturing establishments to produce military supplies. From the outset, the Confederates relied heavily on funds borrowed outside the South to purchase supplies abroad.

Figure 3 shows the sources of revenue collected by the Union government during the war. In 1862 and 1863 the government covered less than 15 percent of its total expenditures through taxes. With the imposition of a higher tariff, excise taxes, and the introduction of the first income tax in American history, this situation improved somewhat, and by the war's end 25 percent of the federal government revenues had been collected in taxes. But what of the other 75 percent? In 1862 Congress authorized the U.S. Treasury to issue currency notes that were not backed by gold. By the end of the war, the treasury had printed more than $250 million worth of these "Greenbacks" and, together with the issue of gold-backed notes, the printing of money accounted for 18 percent of all government revenues. This still left a huge shortfall in revenue that was not covered by either taxes or the printing of money. The remaining revenues were obtained by borrowing funds from the public. Between 1861 and 1865 the debt obligation of the Federal government increased from $65 million to $2.7 billion (including the increased issuance of notes by the Treasury). The financial markets of the North were strained by these demands, but they proved equal to the task. In all, Northerners bought almost $2 billion worth of treasury notes and absorbed $700 million of new currency. Consequently, the Northern economy was able to finance the war without a significant reduction in private consumption. While the increase in the national debt seemed enormous at the time, events were to prove that the economy was more than able to deal with it. Indeed, several economic historians have claimed that the creation and subsequent retirement of the Civil War debt ultimately proved to be a significant impetus to post-war growth (Williamson 1974; James 1984). Wartime finance also prompted a significant change in the banking system of the United States. In 1862 Congress finally passed legislation creating the National Banking System. Their motive was not only to institute the program of banking reform pressed for many years by the Whigs and the Republicans; the newly-chartered federal banks were also required to purchase large blocs of federal bonds to hold as security against the issuance of their national bank notes.

The efforts of the Confederate government to pay for their war effort were far more chaotic than in the North, and reliable expenditure and revenue data are not available. Figure 4 presents the best revenue estimates we have for the Richmond government from 1861 though November 1864 (Burdekin and Langdana 1993). Several features of Confederate finance immediately stand out in comparison to the Union effort. First is the failure of the Richmond government to finance their war expenditures through taxation. Over the course of the war, tax revenues accounted for only 11 percent of all revenues. Another contrast was the much higher fraction of revenues accounted for by the issuance of currency on the part of the Richmond government. Over a third of the Confederate government's revenue came from the printing press. The remainder came in the form of bonds, many of which were sold abroad in either London or Amsterdam. The reliance on borrowed funds proved to be a growing problem for the Confederate treasury. By mid-1864 the costs of paying interest on outstanding government bonds absorbed more than half all government expenditures. The difficulties of collecting taxes and floating new bond issues had become so severe that in the final year of the war the total revenues collected by the Confederate Government actually declined.

The printing of money and borrowing on such a huge scale had a dramatic effect on the economic stability of the Confederacy. The best measure of this instability and eventual collapse can be seen in the behavior of prices. An index of consumer prices is plotted together with the stock on money from early 1861 to April 1865 in Figure 5. By the beginning of 1862 prices had already doubled; by middle of 1863 they had increased by a factor of 13. Up to this point, the inflation could be largely attributed to the money placed in the hands of consumers by the huge deficits of the government. Prices and the stock of money had risen at roughly the same rate. This represented a classic case of what economists call demand-pull inflation: too much money chasing too few goods. However, from the middle of 1863 on, the behavior of prices no longer mirrors the money supply. Several economic historians have suggested that at this point the prices reflect people's confidence in the future of the Confederacy as a viable state (Burdekin and Langdana 1993; Weidenmier 2000). Figure 5 identifies three major military "turning points" between 1863 and 1865. In late 1863 and early 1864, following the Confederate defeats at Gettysburg and Vicksburg, prices rose very sharply despite a marked decrease in the growth of the money supply. When the Union offensives in Georgia and Virginia stalled in the summer of 1864, prices stabilized for a few months, only to resume their upward spiral after the fall of Atlanta in September 1864. By that time, of course, the Confederate cause was clearly doomed. By the end of the war, inflation had reached a point where the value of the Confederate currency was virtually zero. People had taken to engaging in barter or using Union dollars (if they could be found) to conduct their transactions. The collapse of the Confederate monetary system was a reflection of the overall collapse of the economy's efforts to sustain the war effort.

The Union also experienced inflation as a result of deficit finance during the war; the consumer price index rose from 100 at the outset of the war to 175 by the end of 1865. While this is nowhere near the degree of economic disruption caused by the increase in prices experienced by the Confederacy, a doubling of prices did have an effect on how the burden of the war's costs were distributed among various groups in each economy. Inflation is a tax, and it tends to fall on those who are least able to afford it. One group that tends to be vulnerable to a sudden rise in prices is wage earners. Table 4 presents data on prices and wages in the United States and the Confederacy. The series for wages has been adjusted to reflect the decline in purchasing power due to inflation. Not surprisingly, wage earners in the South saw the real value of their wages practically disappear by the end of the war. In the North the situation was not as severe, but wages certainly did not keep pace with prices; the real value of wages fell by about 20 percent. It is not obvious why this happened. The need for manpower in the army and the demand for war production should have created a labor shortage that would drive wages higher. While the economic situation of laborers deteriorated during the war, one must remember that wage earners in 1860 were still a relatively small share of the total labor force. Agriculture, not industry, was the largest economic sector in the north, and farmers fared much in terms of their income during the war than did wage earners in the manufacturing sector (Ransom 1998:255-64; Atack and Passell 1994:368-70).

|

Table 4: Indices of Prices and Real Wages During the Civil War (1860=100)

|

|||||

|

|

Union |

|

Confederate |

||

|

Year |

Prices |

Real Wages |

|

Prices |

Real Wages |

|

1860 |

100 |

100 |

|

100 |

100 |

|

1861 |

101 |

100 |

|

121 |

86 |

|

1862 |

113 |

93 |

|

388 |

35 |

|

1863 |

139 |

84 |

|

1,452 |

19 |

|

1864 |

176 |

77 |

|

3,992 |

11 |

|

1865 |

175 |

82 |

|

|

|

|

Source: Union: (Atack and Passell 1994: 367, Table 13.5) Confederate: (Lerner 1954) |

|||||

Overall, it is clear that the North did a far better job of mobilizing the economic resources needed to carry on the war. The greater sophistication and size of Northern markets meant that the Union government could call upon institutional arrangements that allowed for a more efficient system of redirecting resources into wartime production than was possible in the South. The Confederates depended far more upon outside resources and direct intervention in the production of goods and services for their war effort, and in the end the domestic economy could not bear up under the strain of the effort. It is worth noting in this regard, that the Union blockade, which by 1863 had largely closed down not only the external trade of the South with Europe, but also the coastal trade that had been an important element in the antebellum transportation system, may have played a more crucial part in bringing about the eventual collapse of the Southern war effort than is often recognized (Ransom 2002).

The Civil War as a Watershed in American Economic History

It is easy to see why contemporaries believed that the Civil War was a watershed event in American History. With a cost of billions of dollars and 625,000 men killed, slavery had been abolished and the Union had been preserved. Economic historians viewing the event fifty years later could note that the half-century following the Civil War had been a period of extraordinary growth and expansion of the American economy. But was the war really the "Second American Revolution" as Beard (1927) and Louis Hacker (1940) claimed? That was certainly the prevailing view as late as 1960, when Thomas Cochran (1961) published an article titled "Did the Civil War Retard Industrialization?" Cochran pointed out that, until the 1950s, there was no quantitative evidence to prove or disprove the Beard-Hacker thesis. Recent quantitative research, he argued, showed that the war had actually slowed the rate of industrial growth. Stanley Engerman expanded Cochran's argument by attacking the Beard-Hacker claim that political changes -- particularly the passage in 1862 of the Republican program of political economy that had been bottled up in Congress by Southern opposition -- were instrumental in accelerating economic growth (Engerman 1966). The major thrust of these arguments was that neither the war nor the legislation was necessary for industrialization -- which was already well underway by 1860. "Aside from commercial banking," noted one commentator, "the Civil War appears not to have started or created any new patterns of economic institutional change" (Gilchrist and Lewis 1965: 174). Had there been no war, these critics argued, the trajectory of economic growth that emerged after 1870 would have done so anyway.

Despite this criticism, the notion of a "second" American Revolution lives on. Clearly the Beards and Hacker were in error in their claim that industrial growth accelerated during the war. The Civil War, like most modern wars, involved a huge effort to mobilize resources to carry on the fight. This had the effect of making it appear that the economy was expanding due to the production of military goods. However, Beard and Hacker -- and a good many other historians -- mistook this increased wartime activity as a net increase in output when in fact what happened is that resources were shifted away from consumer products towards wartime production (Ransom 1989: Chapter 7). But what of the larger question of political change resulting from the war? Critics of Beard and Hacker claimed that the Republican program would have eventually been enacted even if there been no war; hence the war was not a crucial turning point in economic development. The problem with this line of argument is that it completely misses the point of the Beard-Hacker argument. They would readily agree that in the absence of a war the Republican program of political economy would triumph -- and that is why there was a war! Historians who argue that economic forces were an underlying cause of sectional conflicts go on to point out that war was probably the only way to settle those conflicts. In this view, the war was a watershed event in the economic development of the United States because the Union military victory ensured that the "market revolution" would not be stymied by the South's attempt to break up the Union (Ransom 1999).

Whatever the effects of the war on industrial growth, economic historians agree that the war had a profound effect on the South. The destruction of slavery meant that the entire Southern economy had to be rebuilt. This turned out to be a monumental task; far larger than anyone at the time imagined. As noted above in the discussion of the indirect costs of the war, Southerners bore a disproportionate share of those costs and the burden persisted long after the war had ended. The failure of the postbellum Southern economy to recover has spawned a huge literature that goes well beyond the effects of the war.

Economic historians who have examined the immediate effects of the war have reached a few important conclusions. First, the idea that the South was physically destroyed by the fighting has been largely discarded. Most writers have accepted the argument of Ransom and Sutch (2001) that the major "damage" to the South from the war was the depreciation and neglect of property on farms as a significant portion of the male workforce went off to war for several years. Second was the impact of emancipation. Slaveholders lost their enormous investment in slaves as a result of emancipation. Planters were consequently strapped for capital in the years immediately after the war, and this affected their options with regard to labor contracts with the freedmen and in their dealings with capital markets to obtain credit for the planting season. The freedmen and their families responded to emancipation by withdrawing up to a third of their labor from the market. While this was a perfectly reasonable response, it had the effect of creating an apparent labor "shortage" and it convinced white landlords that a free labor system could never work with the ex-slaves; thus further complicating an already unsettled labor market. In the longer run, as Gavin Wright (1986) put it, emancipation transformed the white landowners from "laborlords" to "landlords." This was not a simple transition. While they were able, for the most part, to cling to their landholdings, the ex-slaveholders were ultimately forced to break up the great plantations that had been the cornerstone of the antebellum Southern economy and rent small parcels of land to the freedmen under using a new form of rental contract -- sharecropping. From a situation where tenancy was extremely rare, the South suddenly became an agricultural economy characterized by tenant farms.

The result was an economy that remained heavily committed not only to agriculture, but to the staple crop of cotton. Crop output in the South fell dramatically at the end of the war, and had not yet recovered its antebellum level by 1879. The loss of income was particularly hard on white Southerners; per capita income of whites in 1857 had been $125; in 1879 it was just over $80 (Ransom and Sutch 1979). Table 6 compares the economic growth of GNP in the United States with the gross crop output of the Southern states from 1874 to 1904. Over the last quarter of the nineteenth century, gross crop output in the South rose by about one percent per year at a time when the GNP of United States (including the South) was rising at twice that rate. By the end of the century, Southern per capita income had fallen to roughly two-thirds the national level, and the South was locked in a cycle of poverty that lasted well into the twentieth century. How much of this failure was due solely to the war remains open to debate. What is clear is that neither the dreams of those who fought for an independent South in 1861 nor the dreams of those who hoped that a "New South" that might emerge from the destruction of war after 1865 were realized.

Table 5Annual Rates of Growth of Gross National Product of the U.S. and the Gross Southern Crop Output, 1874 to 1904 |

||

|

|

Annual Percentage Rate of Growth

|

|

|

Interval |

Gross National Product of the U.S. |

Gross Southern Crop Output |

|

1874 to 1884 |

2.79 |

1.57 |

|

1879 to 1889 |

1.91 |

1.14 |

|

1884 to 1894 |

0.96 |

1.51 |

|

1889 to 1899 |

1.15 |

0.97 |

|

1894 to 1904 |

2.30 |

0.21 |

|

|

|

|

|

1874 to 1904

|

2.01

|

1.10

|

|

Source: (Ransom and Sutch 1979: 140, Table 7.3 |

||

References

Atack, Jeremy, and Peter Passell. A New Economic View of American History from Colonial Times to 1940. Second edition. New York: W.W. Norton, 1994.

Beard, Charles, and Mary Beard. The Rise of American Civilization. Two volumes. New York: Macmillan, 1927.

Bensel, Richard F. Yankee Leviathan: The Origins of Central State Authority in America, 1859-1877. New York: Cambridge University Press, 1990.

Brown, Richard D. Modernization: The Transformation of American Life, 1600-1865. New York: Hill and Wang, 1976.

Burdekin, Richard C.K., and Farrokh K. Langdana. "War Finance in the Southern Confederacy." Explorations in Economic History 30 (1993): 352-377.

Cochran, Thomas C. "Did the Civil War Retard Industrialization?" Mississippi Valley Historical Review 48 (September 1961): 197-210.

Egnal, Marc. "The Beards Were Right: Parties in the North, 1840-1860." Civil War History 47 (2001): 30-56.

Engerman, Stanley L. "The Economic Impact of the Civil War." Explorations in Entrepreneurial History, second series 3 (1966): 176-199 .

Faulkner, Harold Underwood. American Economic History. Fifth edition. New York: Harper & Brothers, 1943.

Gilchrist, David T., and W. David Lewis, editors. Economic Change in the Civil War Era. Greenville, DE: Eleutherian Mills-Hagley Foundation, 1965.

Goldin, Claudia Dale. "The Economics of Emancipation." Journal of Economic History 33 (1973): 66-85.

Goldin, Claudia, and Frank Lewis. "The Economic Costs of the American Civil War: Estimates and Implications." Journal of Economic History 35 (1975): 299-326.

Goldin, Claudia, and Frank Lewis. "The Post-Bellum Recovery of the South and the Cost of the Civil War: Comment." Journal of Economic History 38 (1978): 487-492.

Gunderson, Gerald. "The Origin of the American Civil War." Journal of Economic History 34 (1974): 915-950.

Hacker, Louis. The Triumph of American Capitalism: The Development of Forces in American History to the End of the Nineteenth Century. New York: Columbia University Press, 1940.

Hughes, J.R.T., and Louis P. Cain. American Economic History. Fifth edition. New York: Addison Wesley, 1998.

Huston, James L. "Property Rights in Slavery and the Coming of the Civil War." Journal of Southern History 65 (1999): 249-286.

James, John. "Public Debt Management and Nineteenth-Century American Economic Growth." Explorations in Economic History 21 (1984): 192-217.

Lerner, Eugene. "Money, Prices and Wages in the Confederacy, 1861-65." Ph.D. dissertation, University of Chicago, Chicago, 1954.

McPherson, James M. "Antebellum Southern Exceptionalism: A New Look at an Old Question." Civil War History 29 (1983): 230-244.

McPherson, James M. Battle Cry of Freedom: The Civil War Era. New York: Oxford University Press, 1988.

North, Douglass C. The Economic Growth of the United States, 1790-1860. Englewood Cliffs: Prentice Hall, 1961.

Ransom, Roger L. Conflict and Compromise: The Political Economy of Slavery, Emancipation, and the American Civil War. New York: Cambridge University Press, 1989.

Ransom, Roger L. "The Economic Consequences of the American Civil War." In The Political Economy of War and Peace, edited by M. Wolfson. Norwell, MA: Kluwer Academic Publishers, 1998.

Ransom, Roger L. "Fact and Counterfact: The 'Second American Revolution' Revisited." Civil War History 45 (1999): 28-60.

Ransom, Roger L. "The Historical Statistics of the Confederacy." In The Historical Statistics of the United States, Millennial Edition, edited by Susan Carter and Richard Sutch. New York: Cambridge University Press, 2002.

Ransom, Roger L., and Richard Sutch. "Growth and Welfare in the American South in the Nineteenth Century." Explorations in Economic History 16 (1979): 207-235.

Ransom, Roger L., and Richard Sutch. "Who Pays for Slavery?" In The Wealth of Races: The Present Value of Benefits from Past Injustices, edited by Richard F. America, 31-54. Westport, CT: Greenwood Press, 1990.

Ransom, Roger L., and Richard Sutch. "Conflicting Visions: The American Civil War as a Revolutionary Conflict." Research in Economic History 20 (2001)

Ransom, Roger L., and Richard Sutch. One Kind of Freedom: The Economic Consequences of Emancipation. Second edition. New York: Cambridge University Press, 2001.

Robertson, Ross M. History of the American Economy. Second edition. New York: Harcourt Brace and World, 1955.

United States, Bureau of the Census. Historical Statistics of the United States, Colonial Times to 1970. Two volumes. Washington: U.S. Government Printing Office, 1975.

Walton, Gary M., and Hugh Rockoff. History of the American Economy. Eighth edition. New York: Dryden, 1998.

Weidenmier, Marc. "The Market for Confederate Bonds." Explorations in Economic History 37 (2000): 76-97.

Weingast, Barry. "The Economic Role of Political Institutions: Market Preserving Federalism and Economic Development." Journal of Law, Economics and Organization 11 (1995): 1:31.

Weingast, Barry R. "Political Stability and Civil War: Institutions, Commitment, and American Democracy." In Analytic Narratives, edited by Robert Bates et al. Princeton: Princeton University Press, 1998.

Williamson, Jeffrey. "Watersheds and Turning Points: Conjectures on the Long-Term Impact of Civil War Financing." Journal of Economic History 34 (1974): 636-661.

Wolfson, Murray. "A House Divided against Itself Cannot Stand." Conflict Management and Peace Science 14 (1995): 115-141.

Wright, Gavin. Old South, New South: Revolutions in the Southern Economy since the Civil War. New York: Basic Books, 1986.