I. Markets and Competition

A. What Is a

Market?

1. Definition of market:.......

2. Markets can

take many forms and may be organized (agricultural commodities) or less

organized (ice cream).

B. What Is

Competition?

1. Definition of competitive market:...................

2. Each buyer knows that there are several sellers from which to choose. Sellers know that each buyer purchases only a small amount of the total amount sold.

C. In this

chapter, we will assume that markets are perfectly competitive.

1.

Characteristics of a perfectly competitive market:

2. Because

buyers and sellers must accept the market price as given, they are often called

"price takers."

D.

We will start by studying perfect competition.

1. Perfectly

competitive markets are the easiest to analyze because buyers and sellers take

the price as a given.

2. Because some

degree of competition is present in most markets, many of the lessons that we

learn by studying supply and demand under perfect competition apply in more

complicated markets.

II. Demand

A. The Demand

Curve: The Relationship between Price and Quantity Demanded

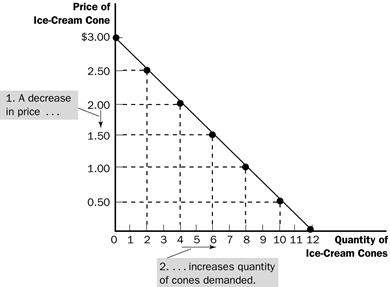

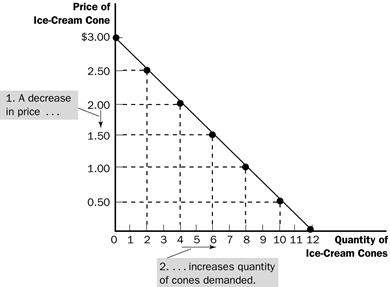

1. Definition

of quantity demanded: the amount

of a good that buyers are willing and able to purchase.

2. One

important relationship of quantity demanded is the price of the product.

b. Definition of law of demand:...............

3. Definition of demand schedule:..................

|

Price of Ice Cream Cone |

Quantity of Cones Demanded |

|

|

$0.00 |

12 |

|

|

$0.50 |

10 |

|

|

$1.00 |

8 |

|

|

$1.50 |

6 |

|

|

$2.00 |

4 |

|

|

$2.50 |

2 |

|

|

$3.00 |

0 |

|

4. Definition of demand curve:.........

Here is an example

B. Market

Demand versus Individual Demand

C. Shifts in

the Demand Curve

1. Because the

market demand curve holds other things constant, it need not be stable over

time.

2. If any of

these other factors change, the demand curve will shift.

a. An increase

in demand is represented by a shift of the demand curve to the right.

b. A decrease

in demand is represented by a shift of the demand curve to the left.

3. Income

b. Definition of normal good:..................

c. Definition of inferior good:......................

4. Prices of

Related Goods

a. Definition of substitutes:....................

b. Definition of complements:...................

5. Tastes

6. Expectations

7. Number of

Buyers

III. Supply

A.

The Supply Curve: The Relationship between Price and Quantity Supplied

1. Definition of quantity supplied:....................

a. Quantity

supplied is positively related to price. This implies that the supply curve will

be upward sloping.

b. Definition

of law of supply:.....................

2. Definition of supply schedule:......................

3. Definition of supply curve:.....................

Here are the examples

|

Price of Ice Cream Cone |

Quantity of Cones Supplied |

|

$0.00 |

0 |

|

$0.50 |

0 |

|

$1.00 |

1 |

|

$1.50 |

2 |

|

$2.00 |

3 |

|

$2.50 |

4 |

|

$3.00 |

5 |

B. Market

Supply versus Individual Supply

C. Shifts in the Supply Curve

1. Because the

market supply curve holds other things constant, the supply curve will shift if

any of these factors changes.

a. An increase

in supply is represented by a shift of the supply curve to the right.

b. A decrease

in supply is represented by a shift of the supply curve to the left.

2. Input Prices

3. Technology

4. Expectations

5. Number of

Sellers

IV. Supply and Demand

Together

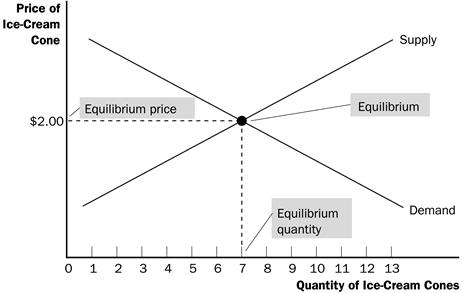

A. Equilibrium

1. The point

where the supply and demand curves intersect is called the market’s equilibrium.

2. Definition of equilibrium:.....................

3. Definition

of equilibrium price:...................

4. The

equilibrium price is often called the "market-clearing" price because both

buyers and sellers are satisfied at this price.

5. Definition of equilibrium quantity:.............

6. If the

actual market price is higher than the equilibrium price, there will be a

surplus of the good.

a. Definition of surplus:.................

b. To

eliminate the surplus, producers will lower the price until the market reaches

equilibrium.

7. If the

actual price is lower than the equilibrium price, there will be a shortage of

the good.

a. Definition of shortage:.................

b. Sellers

will respond to the shortage by raising the price of the good until the market

reaches equilibrium.

B. Three Steps to Analyzing Changes in Equilibrium

1. Decide

whether the event shifts the supply or demand curve (or perhaps both).

2. Determine

the direction in which the curve shifts.

3. Use the

supply-and-demand diagram to see how the shift changes the equilibrium price and

quantity.

D. Shifts in

Curves versus Movements along Curves

I.

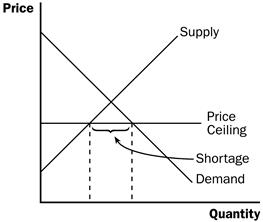

Controls on Prices

A. Definition of price ceiling:.................

B. Definition of price floor:.................

C. How Price Ceilings Affect Market Outcomes

1. There are

two possible outcomes if a price ceiling is put into place in a market.

a. If the

price ceiling is higher than or equal to the equilibrium price, it is not

binding and has no effect on the price or quantity sold.

b. If the

price ceiling is lower than the equilibrium price, the ceiling is a binding

constraint and a shortage is created.

2. If a

shortage for a product occurs (and price cannot adjust to eliminate it), a

method for rationing the good must develop.

3. Not all

buyers benefit from a price ceiling because some will be unable to purchase the

product.

4.

Case Study: Lines at the Gas Pump

a. In 1973,

OPEC raised the price of crude oil, which led to a reduction in the supply of

gasoline.

b. The federal

government put a price ceiling into place and this created large shortages.

c.

Motorists were forced to spend large amounts of time in line at the gas pump

(which is how the gas was rationed).

d. Eventually,

the government realized its mistake and repealed the price ceiling.

5. Case Study: Rent Control in the Short Run and the Long Run

a. The goal of

rent control is to make housing more affordable for the poor.

b. Because the

supply of apartments is fixed (perfectly inelastic) in the short run and upward

sloping (elastic) in the long run, the shortage is much larger in the long run

than in the short run.

c.

Rent-controlled apartments are rationed in a number of ways including long

waiting lists, discrimination against minorities and families with children, and

even under-the-table payments to landlords.

d. The quality

of apartments also suffers due to rent control.

D. How Price

Floors Affect Market Outcomes

1. There are two possible outcomes if a price floor is put into place in a market.

a. If the

price floor is lower than or equal to the equilibrium price, it is not binding

and has no effect on the price or quantity sold.

b. If the

price floor is higher than the equilibrium price, the floor is a binding

constraint and a surplus is created.

2.

Case Study: The Minimum Wage

a. The market

for labor looks like any other market: downward-sloping demand, upward-sloping

supply, an equilibrium price (called a wage), and an equilibrium quantity of

labor hired.

b. If the

minimum wage is above the equilibrium wage in the labor market, a surplus of

labor will develop (unemployment).

c. The

minimum wage will be a binding constraint only in markets where equilibrium

wages are low.

d. Thus, the

minimum wage will have its greatest impact on the market for teenagers and other

unskilled workers.

E. Evaluating

Price Controls

1. Because most

economists feel that markets are usually a good way to organize economic

activity, most oppose the use of price ceilings and floors.

a. Prices

balance supply and demand and thus coordinate economic activity.

b. If prices are set by laws, they obscure the signals that efficiently allocate scarce resources.

2. Price

ceilings and price floors often hurt the people they are intended to help.

a. Rent

controls create a shortage of quality housing and provide disincentives for

building maintenance.

b. Minimum wage laws create higher rates of unemployment for teenage and low skilled workers.

3.

In the News: President Chavez Versus the

Market

a.

b. This

Wall Street Journal article describes the problems generated in