I. What

Are Costs?

A. Total

Revenue, Total Cost, and Profit

1. The goal of

a firm is to maximize profit.

2. Definition of total revenue:

3. Definition

of total cost:

4. Definition of profit:

B. Costs as

Opportunity Costs

1. Principle

#2: The cost of something is what you give up to get it.

2. The costs of

producing an item must include all of the opportunity costs of inputs used in

production.

3. Total

opportunity costs include both implicit and explicit costs.

a. Definition

of explicit costs:.

b. Definition of implicit costs:

c. The

total cost of a business is the sum of explicit costs and implicit costs.

C. The Cost of

Capital as an Opportunity Cost

1. The

opportunity cost of financial capital is an important cost to include in any

analysis of firm performance.

2. Example:

Caroline uses $300,000 of her savings to start her firm. It was in a savings

account paying 5% interest.

3. Because

Caroline could have earned $15,000 per year on this savings, we must include

this opportunity cost. (Note that an accountant would not count this $15,000 as

part of the firm's costs.)

4. If Caroline

had instead borrowed $200,000 from a bank and used $100,000 from her savings,

the opportunity cost would not change if the interest rate stayed the same

(according to the economist). But the accountant would now count the $10,000 in

interest paid for the bank loan.

D. Economic Profit versus Accounting Profit

Definition of economic profit:

Definition of

accounting profit:.

II. Production and Costs

1. Definition of production function:

|

Number

of Workers |

Output |

Marginal

Product of Labor |

Cost of

Factory |

Cost of

Workers |

Total

Cost of Inputs |

|

0 |

0 |

--- |

$30 |

$0 |

$30 |

|

1 |

50 |

50 |

30 |

10 |

40 |

|

2 |

90 |

40 |

30 |

20 |

50 |

|

3 |

120 |

30 |

30 |

30 |

60 |

|

4 |

140 |

20 |

30 |

40 |

70 |

|

5 |

150 |

10 |

30 |

50 |

80 |

|

6 |

155 |

5 |

30 |

60 |

90 |

Definition of marginal product:

Definition of diminishing marginal product:

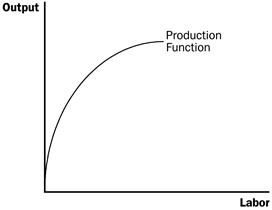

4. We can draw

a graph of the firm's production function by plotting the level of labor (x-axis)

against the level of output (y-axis).

NOTE!!!! I will do a simple example in this study guide. Our in class assignments were more complex and included specialization. These only have crowding.

a. The slope

of the production function measures marginal product.

b. Diminishing marginal product can be seen from the fact that the slope falls as the amount of labor used increases.

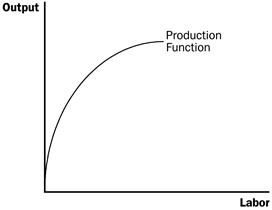

B. From the

Production Function to the Total-Cost Curve

1. We can draw

a graph of the firm's total cost curve by plotting the level of output (x-axis)

against the total cost of producing that output (y-axis).

a. The total

cost curve gets steeper and steeper as output rises.

III.

The Various Measures of Cost

1. Definition

of fixed costs:

2. Definition

of variable costs:

![]()

3. Total cost is equal to

fixed cost plus variable cost.

|

Output |

Total

Cost |

Fixed

Cost |

Variable

Cost |

Average

Fixed Cost |

Average

Variable Cost |

Average

Total Cost |

Marginal

Cost |

|

0 |

$3.00 |

$3.00 |

$0 |

--- |

--- |

--- |

--- |

|

1 |

3.30 |

3.00 |

0.30 |

$3.00 |

$0.30 |

$3.30 |

$0.30 |

|

2 |

3.80 |

3.00 |

0.80 |

1.50 |

0.40 |

1.90 |

0.50 |

|

3 |

4.50 |

3.00 |

1.50 |

1.00 |

0.50 |

1.50 |

0.70 |

|

4 |

5.40 |

3.00 |

2.40 |

0.75 |

0.60 |

1.35 |

0.90 |

|

5 |

6.50 |

3.00 |

3.50 |

0.60 |

0.70 |

1.30 |

1.10 |

|

6 |

7.80 |

3.00 |

4.80 |

0.50 |

0.80 |

1.30 |

1.30 |

|

7 |

9.30 |

3.00 |

6.30 |

0.43 |

0.90 |

1.33 |

1.50 |

|

8 |

11.00 |

3.00 |

8.00 |

0.38 |

1.00 |

1.38 |

1.70 |

|

9 |

12.90 |

3.00 |

9.90 |

0.33 |

1.10 |

1.43 |

1.90 |

|

10 |

15.00 |

3.00 |

12.00 |

0.30 |

1.20 |

1.50 |

2.10 |

C. Average and

Marginal Cost

1. Definition

of average total cost:

2. Definition

of average fixed cost:

3. Definition

of average variable cost:

4. Definition

of marginal cost:

![]()

5. Average

total cost tells us the cost of a typical unit of output and marginal cost tells

us the cost of an additional unit of output.

D. Cost Curves and Their Shapes

1. Rising

Marginal Cost

a. This occurs

because of diminishing marginal product.

b. At a low

level of output, there are few workers and a lot of idle equipment. But as

output increases, the coffee shop gets crowded and the cost of producing another

unit of output becomes high.

2. U-Shaped

Average Total Cost

a. Average

total cost is the sum of average fixed cost and average variable cost.

![]()

b.

AFC declines as output expands and

AVC typically increases as output

expands. AFC is high when output

levels are low. As output expands, AFC

declines pulling ATC down. As fixed

costs get spread over a large number of units, the effect of

AFC on

ATC falls and

ATC begins to rise because of

diminishing marginal product.

3.

The Relationship between Marginal Cost and Average Total Cost

a. Whenever

marginal cost is less than average total cost, average total cost is falling.

Whenever marginal cost is greater than average total cost, average total cost is

rising.

b. The marginal-cost curve crosses the average-total-cost curve at minimum average total cost.

4.

Typical Cost Curves

a. Marginal

cost eventually rises with output.

b. The

average-total-cost curve is U-shaped.

c. Marginal cost crosses average total cost at the minimum of average total cost.

I. What

Is a Competitive Market?

A. The Meaning of Competition

1. Definition of competitive market:

Total revenue

from the sale of output is equal to price times quantity.

![]()

Definition of

marginal revenue: the change in

total revenue from an additional unit sold.

![]()

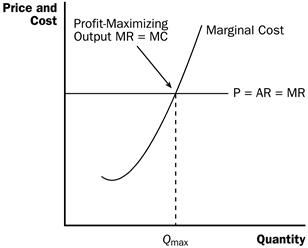

II. Profit Maximization and the Competitive Firm's Supply Curve

The Marginal-Cost Curve and the Firm's Supply Decision

1. Cost curves

have special features that are important for our analysis.

a. The

marginal-cost curve is upward sloping.

b. The average-total-cost curve is U-shaped.

c. The marginal-cost curve crosses the average-total-cost curve at the minimum of average total cost.

2. Marginal and

average revenue can be shown by a horizontal line at the market price.

3. To find the

profit-maximizing level of output, we can follow the same rules that we

discussed above.

a. If marginal

revenue is greater than the marginal cost, the firm should increase its output.

b. If marginal

cost is greater than marginal revenue, the firm should decrease its output.

c. At

the profit-maximizing level of output, marginal revenue and marginal cost are

exactly equal.

4. These rules apply not only to competitive firms, but to firms with market power as well.

C. The Firm's

Short-Run Decision to Shut Down

1. In certain

circumstances, a firm will decide to shut down and produce zero output.

2. There is a

difference between a temporary shutdown of a firm and an exit from the market.

a. A shutdown

refers to a short-run decision not to produce anything during a specific period

of time because of current market conditions.

b. Exit refers

to a long-run decision to leave the market.

c. One

important difference is that, when a firm shuts down temporarily, it still must

pay fixed costs. If a firm exits the industry in the long run, it has no costs.

3. If a firm

shuts down, it will earn no revenue and will have only fixed costs (no variable

costs).

4. Therefore, a

firm will shut down if the revenue that it would get from producing is less than

its variable costs of production:

Shut down if

TR <

VC.

5. Because

TR =

P x

Q and

VC =

AVC x

Q, we can rewrite this condition as:

Shut down if

P <

AVC.

6. We now can

tell exactly what the firm will do to maximize profit (or minimize loss).

a. If the

price is less than average variable cost, the firm will produce no output.

b. If the

price is above average variable cost, the firm will produce the level of output

where marginal revenue (price) is equal to marginal cost.

|

If: |

The Firm

Will: |

|

P ≥

AVC |

Produce output level where

MR =

MC |

|

P <

AVC |

Shut down and produce zero

output |

7. Therefore, the competitive firm's short-run supply curve is the portion of its marginal revenue curve that lies above average variable cost.

8. Spilt Milk

and Other Sunk Costs

a. Definition

of sunk cost: a cost that has

been committed and cannot be recovered.

b. Once a cost

is sunk, it is no longer an opportunity cost.

c. Because nothing can be done about sunk costs, you should ignore them when making decisions.

D. The Firm's

Long-Run Decision to Exit or Enter a Market

1. If a firm

exits the market, it will earn no revenue, but it will have no costs as well.

2. Therefore, a

firm will exit if the revenue that it would earn from producing is less than its

total costs:

Exit if

TR <

TC.

3. Because

TR =

P x

Q and

TC =

ATC x

Q, we can rewrite this condition as:

Exit if

P <

ATC.

4. A firm will

enter an industry when there is profit potential, so this must mean that a firm

will enter if revenues will exceed costs:

Enter if

P >

ATC.

5. Because, in

the long run, a firm will remain in a market only if

P ≥

ATC, the firm's long-run supply curve

will be its marginal cost curve above ATC.

|

If: |

The Firm

Will: |

|

P >

ATC |

Enter because economic

profits are earned |

|

P =

ATC |

Not enter or exit because

economic profits are zero |

|

P <

ATC |

Exit because economic

losses are incurred |

E. Measuring

Profit in Our Graph for the Competitive Firm

1. Recall that

Profit = TR −TC.

2. Because

TR =

P x

Q and

TC =

ATC x

Q, we can rewrite this equation:

Profit = (P

– ATC) x

Q.

3. Using this equation, we can measure the amount of profit (or loss) at the firm's profit-maximizing level of output (or loss-minimizing level of output).

III. The Supply Curve in a

Competitive Market

A. The Short Run: Market Supply with a Fixed Number of Firms

1. Example: a

market with 1,000 identical firms.

2. Each firm's

short-run supply curve is its marginal cost curve above average variable cost.

3. To get the

market supply curve, we add the quantity supplied by each firm in the market at

every given price.

B. The Long Run: Market Supply with Entry and Exit

1. If firms in

an industry are earning profit, this will attract new firms.

a. The supply

of the product will increase (the supply curve will shift to the right).

b. The price

of the product will fall and profit will decline.

2. If firms in

an industry are incurring losses, firms will exit.

a. The supply

of the product will decrease (the supply curve will shift to the left).

b. The price

of the product will rise and losses will decline.

3. At the end

of this process of entry or exit, firms that remain in the market must be

earning zero economic profit.

4. Because

Profit = TR –TC,

profit will only be zero when:

TR =

TC.

5. Because

TR =

P x

Q and

TC =

ATC x

Q, we can rewrite this as:

P =

ATC.

6. Therefore,

the process of entry or exit ends only when price and average total cost become

equal.

7. This implies

that the long-run equilibrium of a competitive market must have firms operating

at their efficient scale.