I.

Microeconomics and Macroeconomics

A. Definition of microeconomics:

B. Definition of macroeconomics:

II. The

Economy’s Production, Income and Expenditure

A. To judge

whether or not an economy is doing well, it is useful to look at Gross Domestic

Product (GDP).

1. GDP measures

the total production in the economy.

2. GDP measures the total income of everyone in the

economy.

2. GDP measures

total expenditure on an economy’s output of goods and services.

B. For an

economy as a whole, total income must equal total expenditure.

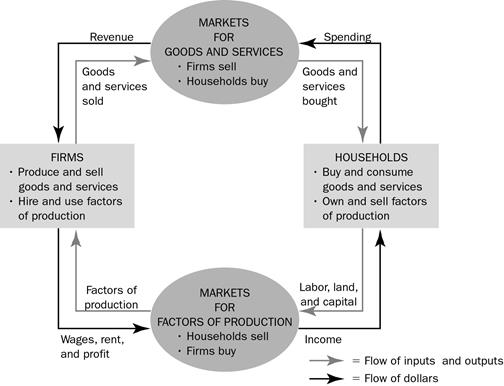

a. Households

buy goods and services from firms; firms use this money to pay for resources

purchased from households.

b. In the

simple economy described by this circular-flow diagram, calculating GDP could be

done by adding up the total purchases of households or summing total income

earned by households.

III. The Measurement of

Gross Domestic Product

A. Definition

of gross domestic product (GDP):

the market value of all final goods and services produced within a country in a

given period of time.

B. “GDP Is the

Market Value . . .”

C. “. . . Of

All . . .”

D. “. . . Final

. . .”

E. “. . . Goods

and Services . . .”

F. “. . .

Produced . . .”

G. “. . .

Within a Country . . .”

H. “. . . in a

Given Period of Time.”

IV. The Components of

GDP

A. GDP (Y

) can be divided into four components: consumption (C

), investment (I ),

government purchases (G ),

and net exports (NX ).

![]()

B. Definition of consumption:

C. Definition of investment:

1. housing

D. Definition of government purchases:

Transfer

payments are not included as part of the government purchases component of GDP.

. Definition of net exports:

V. Real Versus

Nominal GDP

A. There are

two possible reasons for total spending to rise from one year to the next.

1. The economy

may be producing a larger output of goods and services.

2. Goods and

services could be selling at higher prices.

B. When

studying GDP over time, economists would like to know if output has changed (not

prices).

C. Thus,

economists measure real GDP by valuing output using a fixed set of prices.

Definition of nominal GDP:

Definition of real GDP:

E. Because real GDP is unaffected by changes in prices over time, changes in real GDP reflect changes in the amount of goods and services produced.

VI. Is GDP a Good Measure of Economic Well-Being?

A. GDP measures

both an economy’s total income and its total expenditure on goods and services.

B. GDP per

person tells us the income and expenditure level of the average person in the

economy.

C. GDP,

however, may not be a very good measure of the economic well-being of an

individual.

1. GDP omits

important factors in the quality of life including leisure, the quality of the

environment, and the value of goods produced but not sold in formal markets.

2. GDP also

says nothing about the distribution of income.

3. However, a

higher GDP does help us achieve a good life. Nations with larger GDP generally

have better education and better health care.

I. The

Meaning of Money

A. Definition of money:

B. The

Functions of Money

1. Money serves

three functions in our economy.

a. Definition of medium of exchange:

b. Definition of unit of account:

c. Definition of store of value:

2. Definition of liquidity:

a. Money is

the most liquid asset available.

b. Other

assets (such as stocks, bonds, and real estate) vary in their liquidity.

c. When

people decide in what forms to hold their wealth, they must balance the

liquidity of each possible asset against the asset’s usefulness as a store of

value.

C. The Kinds of

Money

1. Definition of commodity money:

2. Definition of fiat money:

3.

IDefinition of

bank notes:

D. Money in the

U.S. Economy

1. The quantity

of money circulating in the United States is sometimes called the

money stock.

2. Included in

the measure of the money supply are currency, demand deposits, and other

monetary assets.

a. Definition of currency:

b. Definition of demand deposits:

a. Credit

cards are not a form of money; when a person uses a credit card, he or she is

simply deferring payment for the item.

b. Because

using a debit card is like writing a check, the account balances that lie behind

debit cards are included in the measures of money.

II. The Federal

Reserve System

A. Definition of Federal Reserve (Fed):

B. Definition

of central bank:

C. The Fed’s

Organization

1. The Fed was

created in 1913 after a series of bank failures.

2. The Fed is

run by a Board of Governors with 7 members who serve 14-year terms.

a. The Board

of Governors has a chairman who is appointed for a four-year term.

b. The current chairman is...

3. The Federal

Reserve System is made up of 12 regional Federal Reserve Banks located in major

cities around the country.

4. One job

performed by the Fed is the regulation of banks to ensure the health of the

nation’s banking system.

a. The Fed

monitors each bank's financial condition and facilitates bank transactions by

clearing checks.

b. The Fed

also makes loans to banks when they want (or need) to borrow.

5. The second

job of the Fed is to control the quantity of money available in the economy.

a. Definition of money supply:

b. Definition of monetary policy:

D. The Federal

Open Market Committee

1. The Federal

Open Market Committee (FOMC) consists of the 7 members of the Board of Governors

and 5 of the 12 regional Federal Reserve District Bank presidents.

2. The primary

way in which the Fed increases or decreases the supply of money is through open

market operations (which involve the purchase or sale of U.S. government bonds).

a. If the Fed

wants to increase the supply of money, it creates dollars and uses them to

purchase government bonds from the public through the nation's bond markets.

b. If the Fed

wants to lower the supply of money, it sells government bonds from its portfolio

to the public. Money is then taken out of the hands of the public and the supply

of money falls.

III. Banks and the Money

Supply

a. Definition of reserves:

The financial

position of the bank can be described with a T-account:

|

FIRST NATIONAL BANK |

|||

|

Assets |

Liabilities |

||

|

Reserves |

$100.00 |

Deposits |

$100.00 |

B. Money

Creation with Fractional-Reserve Banking

1. Definition of fractional-reserve banking:

2. Definition

of reserve ratio:

Definition of money multiplier:

D. The Fed’s

Tools of Monetary Control

1. Definition of open market operations:

a. If the Fed

wants to increase the supply of money, it creates dollars and uses them to

purchase government bonds from the public in the nation's bond markets.

b. If the Fed

wants to lower the supply of money, it sells government bonds from its portfolio

to the public in the nation's bond markets. Money is then taken out of the hands

of the public and the supply of money falls.

2. Definition of reserve requirements: r

3. Definition of discount rate:

a. When a bank

cannot meet its reserve requirements, it may borrow reserves from the Fed.

b. A higher

discount rate discourages banks from borrowing from the Fed and likely

encourages banks to hold onto larger amounts of reserves. This in turn lowers

the money supply.

c. A

lower discount rate encourages banks to lend their reserves (and borrow from the

Fed). This will increase the money supply.