1) You are scheduled for work on Saturday, but a friend

asks you to go to a concert. What is

the true cost of going to the concert?

Now suppose that you had been planning to spend the day studying at the

library. What is the cost of going

to the concert in this case?

Explain.

If you are thinking of

going to a concert instead of working at your part-time job, the cost of concert

includes its monetary and time costs, which includes the implicit opportunity

cost of the wages you are giving up by not working. If the choice is between

concert and going to the library to study, then the cost of skiing is its

monetary and time costs including the cost of getting lower grades in your

courses and the effect that you may not even realize for many years.

2) You are the manager of a company that has invested $5

million in developing a new product, but the development is behind schedule.

At a recent meeting, your salespeople report that the introduction of

competing products has reduced the expected sales of

your new product to $3 million.

If it would cost $1 million to finish development, should you go ahead

and do so? What is the most that you

should pay to complete development?

The fact that you have

already sunk $5 million is not relevant to your decision anymore, because that

money is gone. What matters now is the chance to earn profits at the margin. If

you spend another $1 million and can generate sales of $3 million, you’ll earn

$2 million in marginal profit, so you should do so. You are right to think that

the project has lost a total of $3 million ($6 million in costs and only $3

million in revenue) and you should not have started it. That is true, but if you

do not spend the additional $1 million, you will not have any sales and your

losses will be $5 million. So what matters is not the total profit, but the

profit you can earn at the margin. In fact, you would pay up to $3 million to

complete development; any more than that, and you will not be increasing profit

at the margin.

3) The United States Social Security system provides

old-aged income for people over age 65.

Recipients with more income from other sources receive smaller benefits

(after taxes) than recipients with less income from other sources.

a) How does the provision of Social Security affect people’s incentive to

save while under the age of 65 and while working?

b) How does the reduction in after-tax benefits associate with higher

income affect people’s incentive to work past age 65?

a.

The provision of Social Security benefits lowers

an individual’s incentive to save for retirement. The benefits provide

some level of income to the individual when he or she retires. This means that

the individual is not entirely dependent on savings to support consumption

through the years in retirement.

b.

Since a person gets fewer after-tax Social Security benefits the greater

his or her earnings are, this decreases your

incentive to work past age 65. The more you work, the lower your after-tax

Social Security benefits will be. Thus, the taxation of Social Security benefits

discourages work effort after age 65.

4) What if the United States switched to central planning

for its economy and you became the planner.

Among the millions of decisions that you need to make for the next year

are how many direct to video movies to produce, what actresses to hire, and who

should receive movies.

a) To make these decisions intelligently, what information would you need

about the movie industry? What

information would you need about each person in the United States?

b) How would your decisions about direct to video movies affect some of

your other decisions, such as how many dvd or hi-def players to make or should

all movies be distributed

through the internet?

How might some of your other decisions about the economy change your

views about direct to video movies?

To produce the right

number of DVDs by the right actors and deliver them to the consumers requires an

enormous amount of information. You need to know about production techniques and

costs in the DVD and movie industry. You need to know each consumer’s tastes and

which actors they want to watch. If you make the wrong decisions, you will be

producing too many DVDs by actors that consumers do not want to watch, and not

enough for the internet. This is just a

superficial answer because there are so many questions that need to be answered.

It would be difficult to do this job well.

5) “Everyone in society should be guaranteed the best

health care possible.” Discuss this

point of view from the standpoints of efficiency and equity.

If everyone were guaranteed the best healthcare possible, much more of our nation’s output would be devoted to medical care than is now the case. Would that be efficient? If you believe that doctors have market power and restrict health care to keep their incomes high, you might think efficiency would increase by providing more healthcare. But more likely, if the government mandated increased spending on healthcare, the economy would be less efficient because it would give people more healthcare than they would choose to pay for. Imagine that you are very old and have one month to live because of a terrible cancer. Would you spend all of your savings (your kid's inheritance) so that you could live an extra week.

From the point of view of equality, if poor people are less likely to have adequate healthcare, providing more health care would represent an improvement. Each person would have a more even slice of the economic pie, though the pie would consist of more healthcare and less of other goods. This is a question that we have addressed with the recent health care debate and ObamaCare.

6) Who is the current chairman of the Federal Reserve? Who

is the current chair of the Council of Economic Advisers?

Who is the current secretary of the

treasury?

Ben Bernanke

Jason Furman

Jacob Lew

7) Imagine a society that produces military goods and

consumer goods, which we’ll call “guns” and “butter.”

a) Draw a

production possibilities frontier for guns and butter.

Using the concept of opportunity cost, explain why it is most likely has

a bowed-out shape.

b) Show a

point that is impossible for the economy to achieve.

Show a point that is feasible but inefficient.

c) Imagine

that the society has two political parties, called the Hawks (who want a strong

military) and the Doves (who want a smaller military).

Show a point on your production possibilities frontier that the Hawks

might choose and a point the Doves might choose.

d) Imagine

that an aggressive neighboring country reduces the size of its military.

As a result, both the Hawks and the Doves reduce their desired production

of guns by the same amount. Which

party would get the bigger “peace dividend,” as measured by the increase in butter

production? Explain.

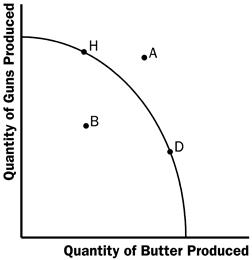

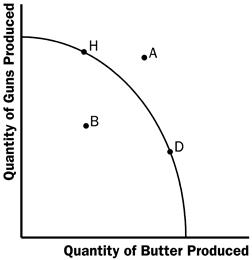

a.

The figure below shows a production possibilities frontier between guns

and butter. It is bowed out because the opportunity cost of butter depends on

how much butter and how many guns the economy is producing. When the economy is

producing a lot of butter, workers and machines best suited to making guns are

being used to make butter, so each unit of guns given up yields a small increase

in the production of butter. Thus, the frontier is steep and the opportunity

cost of producing butter is high. When the economy is producing a lot of guns,

workers and machines best suited to making butter are being used to make guns,

so each unit of guns given up yields a large increase in the production of

butter. Thus, the frontier is very flat and the opportunity cost of producing

butter is low.

Figure

b.

Point A is impossible for the economy to achieve; it is outside the

production possibilities frontier. Point B is feasible but inefficient because

it is inside the production possibilities frontier.

c.

The Hawks might choose a point like H, with many guns and not much

butter. The Doves might choose a point like D, with a lot of butter and few

guns.

d.

If both Hawks and Doves reduced their desired quantity of guns by the

same amount, the Hawks would get a bigger peace dividend because the production

possibilities frontier is much flatter at point H than at point D. As a result,

the reduction of a given number of guns, starting at point H, leads to a much

larger increase in the quantity of butter produced than when starting at point

D.