The textbook was so concise in this area and I wanted to do give you more. This study guide is almost completely the extra parts. I will include parts from the text, but for the most part I will omit that here and let you read the text.

I. Review

of the Definitions of Microeconomics and Macroeconomics

A. Definition

of microeconomics:

B. Definition of macroeconomics:

II. The

Economy’s Production, Income and Expenditure

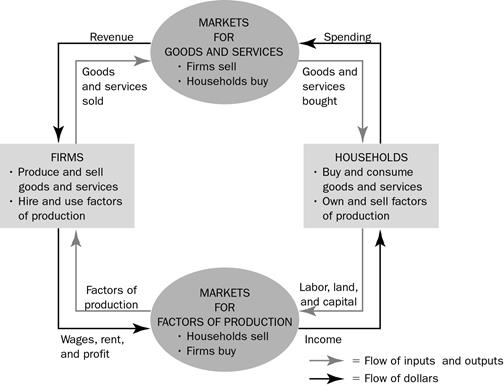

B. For an

economy as a whole, total income must equal total expenditure and they must

equal total production.

a. Households

buy goods and services from firms; firms use this money to pay for resources

purchased from households.

b. In the

simple economy described by this circular-flow diagram, calculating GDP could be

done by adding up the total purchases of households or summing total income

earned by households.

c. Note

that this simple diagram is somewhat unrealistic as it omits saving, taxes,

government purchases, and investment purchases by firms. However, because a

transaction always has a buyer and a seller, total expenditure in the economy

must be equal to total income.

III. The Measurement of

Gross Domestic Product

A. Definition

of gross domestic product (GDP):

B. “GDP Is the

Market Value . . .”

C. “. . . Of All . . .”

D. “. . . Final . . .”

E. “. . . Goods and Services . . .”

F. “. . . Produced . . .”

G. “. . . Within a Country . . .”

H. “. . . in a Given Period of Time.”

FYI: Other Measures of Income

Gross National

Product (GNP) is the total income earned by a nation’s permanent residents.

IV. The Components of

GDP

A. GDP (Y

) can be divided into four components: consumption (C

), investment (I ),

government purchases (G ),

and net exports (NX ).

![]()

B. Definition

of consumption:

C. Definition of investment:

D. Definition of government purchases:

E. Definition of net exports:

V. Real Versus

Nominal GDP

A. There are

two possible reasons for total spending to rise from one year to the next.

B. When

studying GDP over time, economists would like to know if output has changed (not

prices).

C. Thus,

economists measure real GDP by valuing output using a fixed set of prices.

D. A Numerical Example

1. Two goods

are being produced: hot dogs and hamburgers.

|

Year |

Price of

Hot Dogs |

Quantity of

Hot Dogs |

Price of Hamburgers |

Quantity of Hamburgers |

|

2008 |

$1 |

100 |

$2 |

50 |

|

2009 |

$2 |

150 |

$3 |

100 |

|

2010 |

$3 |

200 |

$4 |

150 |

2. Definition

of nominal GDP: the production of

goods and services valued at current prices.

Nominal GDP for 2008 = ($1 × 100) + ($2 × 50) = $200.

Nominal GDP for 2009 = ($2 × 150) + ($3 × 100) = $600.

Nominal GDP for 2010 = ($3 × 200) + ($4 × 150) = $1,200.

3. Definition

of real GDP: the production of

goods and services valued at constant prices.

Let’s assume that the base year is 2008.

Real GDP for 2008 = ($1 × 100) + ($2 × 50) = $200.

Real GDP for 2009 = ($1 × 150) + ($2 × 100) = $350.

Real GDP for 2010 = ($1 × 200) + ($2 × 150) = $500.

E. Because real GDP is unaffected by changes in prices over time, changes in real GDP reflect changes in the amount of goods and services produced.

F. The GDP

Deflator

1. Definition

of GDP deflator: a measure of the

price level calculated as the ratio of nominal GDP to real GDP times 100.

![]()

2. Example

Calculations

GDP Deflator for 2008 = ($200 / $200) × 100 = 100.

GDP Deflator for 2009 = ($600 / $350) × 100 = 171.

GDP Deflator for 2010 = ($1200 / $500) × 100 = 240.

I. Would

you rather have 55K today or 55K in 1900 and all 1900 techno

This is why we like growth

Because of different growth rates, the ranking of countries by

income per person changes over time.

a. In the late

19th century, the United Kingdom was the richest country in the world.

b. Today,

income per person is lower in the United Kingdom than in the United States and

Canada (two former colonies of the United Kingdom).

II.

Productivity: Its Role and Determinants

Why Productivity Is So Important?

Definition of

productivity is…..

How Productivity Is Determined?

A production function describes……..

Growth Dynamics: Our Growth

Model

A. Setup of the Model

1. Basic assumptions

a. Population and work force grow at the same rate n.

b. Closed economy and there are no government purchases of goods and

services

therefore

![]()

c. Rewrite the equation in per capita (per worker) terms by dividing by

the size of

the labor force Nt Denote

per worker values in lower cases

![]()

d. kt is the

capital to labor ratio

2. The production function can

also be represented in per worker terms

a.

![]()

b. Can plot the per-worker production function assuming no productivity growth.

3. Steady states

a. In the steady state the per-capita levels of output, capital and consumption will be constant over time.

(labor force and capital grow at the same

rate…)

sf(k) = (n + d)k

kss is the only

possible steady state capital labor ratio it is where saving is equal to the steady

state level of investment.

If k does not equal kss then

the economy will converge to the steady state level

if k<kss

Then saving > investment needed to keep k constant so k increases

if k>kss Then

saving < investment needed to keep k constant so k decreases

Higher saving rate leads to a

higher capital labor ratio, higher output per worker and consumption per worker

depends on the golden rule.

·

Should policy increase the saving rate?

May lower consumption in the short run, but will increase output per

worker. Trade-off

between future and present consumption

·

Population growth lowers the capital output ratio, lowers consumption per worker

·

Productivity growth

The key factor in determining economic growth – increase the output

worker for a giving level of capital labor ratio

III. Government Policy to

Raise Long Run Living Standards

How can saving be increased?

How can we improve Infrastructure?

How can we build Human Capital?

How can we increase Investment from Abroad

a. Foreign

direct investment occurs when a capital investment is owned and operated by a

foreign entity.

b. Foreign

portfolio investment occurs when a capital investment is financed with foreign

money but operated by domestic residents.

How can we improve Health and Nutrition

Other things being equal, healthier workers are more productive.

How does the US protect Property Rights and promote Political

Stability

How can we promote Free Trade

How can we increase Research and Development