The non-comprehensive part of the final will be over the unemployment chapter and the inflation chapter

I. who should be unemployed

On the surface this seems easy—those that do not work

But what about stay at home moms—individuals what are not willing

to work for low wages at available jobs

Unemployment can be divided into two categories.

A. The

economy’s natural rate of unemployment refers to the amount of unemployment that

the economy normally experiences.

B. Cyclical

unemployment refers to the year-to-year fluctuations in unemployment around its

natural rate.

II. Identifying

Unemployment

A. How Is

Unemployment Measured?

1. The Bureau

of Labor Statistics (BLS) surveys 60,000 households every month.

2. The BLS places each adult (age 16 or older) into one of three categories: employed, unemployed, or not in the labor force.

3. Definition of labor force:....

4. Definition of unemployment rate:.....

5. Definition of labor-force participation rate: the percentage of the adult population that is in the labor force.

a. Women ages

20 and older have lower labor-force participation rates than men, but have

similar rates of unemployment.

b. Blacks ages

20 and older have similar labor-force participation rates to whites, but have

higher rates of unemployment.

c. Teenagers have lower labor-force participation rates than adults, but have higher unemployment rates.

B. Definition of the natural rate of unemployment:........

C. Definition

of cyclical unemployment:

F. Does the

Unemployment Rate Measure What We Want It To?

1. Measuring

the unemployment rate is not as straightforward as it may seem.

2. There is a

tremendous amount of movement into and out of the labor force.

a. Many of the

unemployed are new entrants or reentrants looking for work.

b. Many

unemployment spells end with a person leaving the labor force as opposed to

actually finding a job.

3. There may be

individuals who are calling themselves unemployed to qualify for government

assistance, yet they are not trying hard to find work. These individuals are

more likely not a part of the true labor force, but they will be counted as

unemployed.

4. Definition of discouraged workers:...........

a. These

individuals will not be counted as part of the labor force.

b. Thus, while

they are likely a part of the unemployed, they will not show up in the

unemployment statistics.

H. Why Are

There Always Some People Unemployed?

1. In an ideal

labor market, wages would adjust so that the quantity of labor supplied and the

quantity of labor demanded would be equal.

2. However,

there is always unemployment even when the economy is doing well. The

unemployment rate is never zero; it fluctuates around the natural rate.

a. Definition of frictional unemployment:......

b. Definition of structural unemployment:.....

c. Three

possible reasons for structural unemployment are minimum-wage laws, unions, and

efficiency wages.

III. Job Search

A. Definition

of job search: the process by

which workers find appropriate jobs given their tastes and skills.

B. Because

workers differ from one another in terms of their skills and tastes and jobs

differ in their attributes, it is often difficult for workers to match with the

appropriate job.

C. Why Some

Frictional Unemployment Is Inevitable

1. Frictional

unemployment often occurs because of a change in the demand for labor among

different firms.

a. When

consumers decide to stop buying a good produced by Firm A and instead start

buying a good produced by Firm B, some workers at Firm A will likely lose their

jobs.

b. New jobs

will be created at Firm B, but it will take some time to move the displaced

workers from Firm A to Firm B.

c. The

result of this transition is temporary unemployment.

d. The same

situation can occur across industries and regions as well.

2. This implies

that, because the economy is always changing, frictional unemployment is

inevitable. Workers in declining industries will find themselves looking for new

jobs, and firms in growing industries will be seeking new workers.

D. Public

Policy and Job Search

1. The faster

information spreads about job openings and worker availability, the more rapidly

the economy can match workers and firms.

2. Government

programs can help to reduce the amount of frictional unemployment.

a.

Government-run employment agencies give out information on job vacancies.

b. Public

training programs can ease the transition of workers from declining to growing

industries and help disadvantaged groups escape poverty.

3. Critics of

these programs argue that the private labor market will do a better job of

matching workers with employers and therefore the government should not be

involved in the process of job search.

E.

Unemployment Insurance

1. Definition of unemployment insurance:.....

2. Because

unemployment insurance reduces the hardship of unemployment, it also increases

the amount of unemployment that exists.

IV. Minimum-Wage Laws

A. Unemployment can also occur because of minimum-wage laws.

B. The minimum

wage is a price floor.

1. If the

minimum wage is set above the equilibrium wage in the labor market, a surplus of

labor will occur.

2. However,

this is a binding constraint only when the minimum wage is set above the

equilibrium wage.

a. Most

workers in the economy earn a wage above the minimum wage.

b.

Minimum-wage laws therefore have the largest affect on workers with low skill

and little experience (such as teenagers).

C.

FYI: Who Earns the Minimum Wage?

1. In 2006, the

Department of Labor released a study concerning workers who reported earnings at

or below the minimum wage.

a. Of all

workers paid an hourly rate in the United States, about 2% of men and 3% of

women reported wages at or below the minimum wage.

b.

Minimum-wage workers tend to be young, with about half under the age of 25.

c.

Minimum-wage workers tend to be less educated. Of those workers ages 16 and over

with a high school education, only 2% earned the minimum wage.

d. The

industry with the highest proportion of workers with reported wages at or below

the minimum wage was leisure and hospitality.

e. The

proportion of workers earning the prevailing minimum wage has trended downward

since 1979.

D. Anytime a

wage is kept above the equilibrium level for any reason, the result is

unemployment.

1. Other causes

of this situation include unions and efficiency wages.

2. This

situation is different from frictional unemployment where the search for the

right job is the reason for

unemployment.

V. Unions and

Collective Bargaining

A. Definition of union:......

B. Unions play

a smaller role in the U.S. economy today than they did in the past. However,

unions continue to be prevalent in many European countries.

D. Are Unions

Good or Bad for the Economy?

1. Critics of

unions argue that unions are a cartel, which causes inefficiency because fewer

workers end up being hired at the higher union wage.

2. Advocates of

unions argue that unions are an answer to the problems that occur when a firm

has too much power in the labor market (for example, if it is the only major

employer in town). In addition, by representing workers’ views, unions help

firms provide the right mix of job attributes.

VI. The Theory of

Efficiency Wages

A. Definition of efficiency wages:......

B. Efficiency

wages raise the wage above the market equilibrium wage, resulting in

unemployment.

C. There are

several reasons why a firm may pay efficiency wages.

1. Worker

Health

a. Better-paid

workers can afford to eat better and can afford good medical care.

b. This is

more applicable in developing countries where inadequate nutrition can be a

significant problem.

2. Worker

Turnover

a. A firm can

reduce turnover by paying a wage greater than its workers could receive

elsewhere.

b. This is

especially helpful for firms that face high hiring and training costs.

3. Worker

Quality

a. Offering

higher wages attracts a better pool of applicants.

b. This is

especially helpful for firms that are not able to perfectly gauge the quality of

job applicants.

4.

Worker Effort

a. Again, if a

firm pays a worker more than he or she can receive elsewhere, the worker will be

more likely to try to protect his or her job by working harder.

b. This is

especially helpful for firms that have difficulty monitoring their workers.

INFlATION

I. The

inflation rate is measured as the percentage change in the Consumer Price Index,

the GDP deflator, or some other index of the overall price level.

A. Over the

past 100 years, prices have risen an average of about 4% per year in the United

States.

II. The Classical Theory of Inflation

A. The Level of

Prices and the Value of Money

1. When the

price level rises, people have to pay more for the goods and services that they

purchase.

2. A rise in

the price level also means that the value of money is now lower because each

dollar now buys a smaller quantity of goods and services.

3. If

P is the price level, then the

quantity of goods and services that can be purchased with $1 is equal to 1/P.

B. Money

Supply, Money Demand, and Monetary Equilibrium

1. The value of

money is determined by the supply and demand for money.

2. For the most

part, the supply of money is determined by the Fed.

a. This

implies that the quantity of money supplied is fixed (until the Fed decides to

change it).

b. Thus, the

supply of money will be vertical (perfectly inelastic).

3. The demand

for money reflects how much wealth people want to hold in liquid form.

a. One

variable that is very important in determining the demand for money is the price

level.

b. The higher prices are, the more money that is needed to perform transactions.

c. Thus,

a higher price level (and a lower value of money) leads to a higher quantity of

money demanded.

4. In the long

run, the overall price level adjusts to the level at which the demand for money

equals the supply of money.

a. If the

price level is above the equilibrium level, people will want to hold more money

than is available and prices will have to decline.

b. If the

price level is below equilibrium, people will want to hold less money than that

available and the price level will rise.

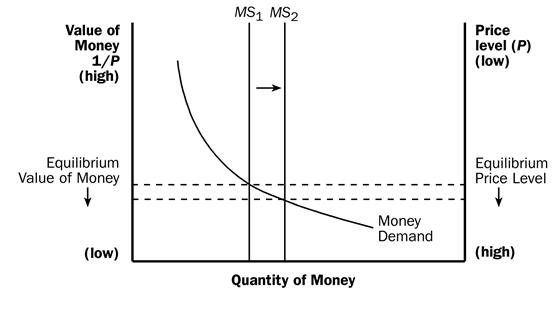

5. We can show

the supply and demand for money using a graph.

a. The

left-hand vertical axis is the value of money, measured by 1/P.

b. The

right-hand vertical axis is the price level (P

). Note that it is inverted—a high value of money means a low price

level and vice versa.

c. At

the equilibrium, the quantity of money demanded is equal to the quantity of

money supplied.

C. The Effects

of a Monetary Injection

1. Assume that

the economy is currently in equilibrium and the Fed suddenly increases the

supply of money.

2. The supply of money shifts to the right.

3. The

equilibrium value of money falls and the price level rises.

4. When an

increase in the money supply makes dollars more plentiful, the result is an

increase in the price level that makes each dollar less valuable.

5. Definition

of quantity theory of money: a

theory asserting that the quantity of money available determines the price level

and that the growth rate in the quantity of money available determines the

inflation rate.

D. A Brief Look

at the Adjustment Process

1. The

immediate effect of an increase in the money supply is to create an excess

supply of money.

2. People try

to get rid of this excess supply in a variety of ways.

a. They may

buy goods and services with the excess funds.

b. They may

use these excess funds to make loans to others by buying bonds or depositing the

money in a bank account. These loans will then be used to buy goods and

services.

c. In

either case, the increase in the money supply leads to an increase in the demand

for goods and services.

d. Because the

supply of goods and services has not changed, the result of an increase in the

demand for goods and services will be higher prices.

F. Velocity and

the Quantity Equation

1. Definition of velocity of money:.....

3. If P is the price level (the GDP deflator), Y is real GDP, and M is the quantity of money

5. Definition

of quantity equation: the

equation M ×

V =

P ×

Y, which relates the quantity of

money, the velocity of money, and the dollar value of the economy’s output of

goods and services.

a. The

quantity equation shows that an increase in the quantity of money must be

reflected in one of the other three variables.

b. Specifically, the price level must rise, output must rise, or velocity must fall.

c.

Figured in the text shows nominal GDP, the quantity of money (as measured by M2)

and the velocity of money for the United States since 1960. It appears that

velocity is fairly stable, while GDP and the money supply have grown

dramatically.

6. We can now

explain how an increase in the quantity of money affects the price level using

the quantity equation.

a. The

velocity of money is relatively stable over time.

b. When the

central bank changes the quantity of money (M

), it will proportionately change the nominal value of output (P

× Y ).

c. The economy’s output of goods and services (Y ) is determined primarily by available resources and technology.

d. This must

mean that P increases proportionately

with the change in M.

e. Thus, when the central bank increases the money supply rapidly, the result is a high level of inflation.

Do prices adjust as in the quantity equations or are they sticky?

The previous unemployment chapter indicates they are sticky and here are some more thoughts. They are old and have old-fasion names, but I ask you can they be updated?

Shoeleather

Costs

1. Because

inflation erodes the value of money that you carry in your pocket, you can avoid

this drop in value by holding less money.

2. However,

holding less money generally means more trips to the bank.

3. Definition

of shoeleather costs: the

resources wasted when inflation encourages people to reduce their money holdings.

4. This cost

can be considerable in countries experiencing hyperinflation.

C. Menu Costs

1. Definition

of menu costs: the costs of

changing prices.

2. During

periods of inflation, firms must change their prices more often.

D.

Relative-Price Variability and the Misallocation of Resources

1. Because

prices of most goods change only once in a while (instead of constantly),

inflation causes relative prices to vary more than they would otherwise.

2. When inflation distorts relative prices, consumer decisions are distorted and markets are less able to allocate resources to their best use.

F. Confusion

and Inconvenience

1. Money is the

yardstick that we use to measure economic transactions.

2. When

inflation occurs, the value of money falls. This alters the yardstick that we

use to measure important variables like incomes and profit.

I. The

Consumer Price Index

A. Definition of consumer price index (CPI):.......

B. How the Consumer Price Index Is Calculated

1. Fix the

basket.

a. The Bureau

of Labor Statistics uses surveys to determine a representative bundle of goods

and services purchased by a typical consumer.

2. Find the

prices.

a. Prices for

each of the goods and services in the basket must be determined for each time

period.

b. Example:

|

Year |

Price of

Hot Dogs |

Price of

Hamburgers |

|

2008 |

$1 |

$2 |

|

2009 |

$2 |

$3 |

|

2010 |

$3 |

$4 |

3. Compute the

basket’s cost.

a. By keeping

the basket the same, only prices are being allowed to change. This allows us to

isolate the effects of price changes over time.

b. Example:

Cost in 2008 = ($1 × 4) + ($2 × 2) = $8.

Cost in 2009 = ($2 × 4) + ($3 × 2) = $14.

Cost in 2010 = ($3 × 4) + ($4 × 2) = $20.

4. Choose a

base year and compute the index.

a. The base

year is the benchmark against which other years are compared.

b. The formula

for calculating the price index is:

c.

Example (using 2008 as the base year):

CPI for 2008 = ($8)/($8) × 100 = 100.

CPI for 2009 = ($14)/($8) × 100 = 175.

CPI for 2010 = ($20)/($8) × 100 = 250.

5. Compute the

inflation rate.

a. Definition of inflation rate: the percentage change in the price index from the preceding period.

b. The formula

used to calculate the inflation rate is:

![]()

c.

Example:

Inflation Rate for 2009 = (175 – 100)/100 × 100% = 75%.

Inflation Rate for 2010 = (250 – 175)/175 × 100% = 43%.

D. FYI: What Is in the CPI’s Basket?

The largest

category is housing, which makes up 43% of a typical consumer’s budget.t

improvements into account when computing the CPI.

F. Problems in

Measuring the Cost of Living

1. Substitution

Bias

a. When the

price of one good changes, consumers often respond by substituting another good

in its place.

b. The CPI

does not allow for this substitution; it is calculated using a fixed basket of

goods and services.

c. This

implies that the CPI overstates the increase in the cost of living over time.

2. Introduction

of New Goods

a. When a new

good is introduced, consumers have a wider variety of goods and services to

choose from.

b. This makes

every dollar more valuable, which lowers the cost of maintaining the same level

of economic well-being.

c.

Because the market basket is not revised often enough, these new goods are left

out of the bundle of goods and services included in the basket.

3. Unmeasured

Quality Change

a. If the

quality of a good falls from one year to the next, the value of a dollar falls;

if quality rises, the value of the dollar rises.

b. Attempts

are made to correct prices for changes in quality, but it is often difficult to

do so because quality is hard to measure.

4. The size of

these problems is also difficult to measure.

5. Most studies

indicate that the CPI overstates the rate of inflation by approximately one

percentage point per year.

6. The issue is

important because many government transfer programs (such as Social Security)

are tied to increases in the CPI.