1. The position of

the FE line is determined by the labor market and the production

function. Labor supply and demand determine equilibrium employment. Using

equilibrium employment in the production function gives the full-employment

level of output. The FE line is vertical at that point. The FE

line shifts to the right if there is an increase in labor supply or the capital

stock or if there is a beneficial supply shock.

2. The IS

curve shows combinations of the real interest rate (r) and output (Y)

that leave the goods market in equilibrium. Equilibrium in the goods market

occurs when the aggregate supply of goods (Y) equals the aggregate demand

for goods (Cd

+

Id

+ G). Since desired national

saving (Sd) is Y

-

Cd

- G, an equivalent condition is

Sd

=

Id. Equilibrium is

achieved by the adjustment of the real interest rate to make the desired level

of saving equal to the desired level of investment. For different levels of

output, there are different desired saving curves, with different equilibrium

interest rates. When plotted on a figure showing output and the real interest

rate, this forms the IS curve, as shown in Figure 9.15. The curve slopes

downward because as output rises, the saving curve shifts along the investment

curve and the real interest rate declines.

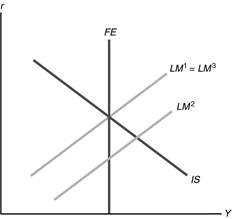

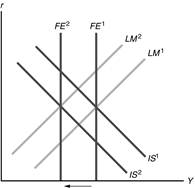

Figure 9.15

The

IS curve could shift down and to the

left if: (1) expected future output falls, because this increases desired

saving; (2) government purchases fall, because this increases desired saving;

(3) the expected future marginal product of capital falls, because this

decreases desired investment; or (4) corporate taxes increase, because this

decreases desired investment.

3. The LM

curve shows the combinations of output and the real interest rate that maintain

equilibrium in the asset market. Equilibrium in the asset market occurs when

real money demand equals the real money supply.

Figure 9.16 shows the derivation of the LM curve and why it slopes

upward. An increase in output from Y1 to Y2

raises money demand, shifting the money demand curve from MD(Y1)

to MD(Y2). With money supply fixed at MS, there

must be a higher real interest rate to get equilibrium in the asset market. This

gives two points of the LM curve, plotted on the right half of the

figure. The result is that higher output increases the real interest rate along

the LM curve, so the LM curve slopes upward.

Figure 9.16

The LM curve would shift down and to the right if the nominal money

supply or expected inflation increased or if the price level or nominal interest

rate on money decreased. In addition, the curve would shift down and to the

right if there were a decrease in wealth, a decrease in the risk of alternative

assets relative to the risk of holding money, an increase in the liquidity of

alternative assets, or an increase in the efficiency of payment technologies.

6.

There is monetary neutrality if a change in the nominal money supply

changes the price level but has no effect on real variables. Once prices adjust,

money is neutral in the IS–LM model, because a change in the money supply

that shifts the LM curve is matched by a proportional change in the price

level that returns the real money supply back to its original level and moves

the LM curve back to its original location. Classical economists believe

that money is neutral in the short run, but Keynesians believe that there may be

sluggish adjustment of the price level, so that changes in the money supply

affect output and the real interest rate in the short run. Both classicals and

Keynesians believe money is neutral in the long run.

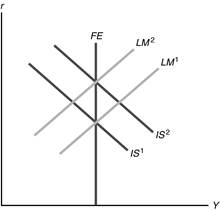

1. (a)

The increase in desired investment

shifts the IS curve up and to the right, as shown in Figure 9.21.

The price level rises, shifting the LM curve up and to the left to

restore equilibrium. Since the real interest rate rises, consumption declines.

In summary, there is no change in the real wage, employment, or output; there is

a rise in the real interest rate, the price level, and investment; and there is

a decline in consumption.

Figure 9.21

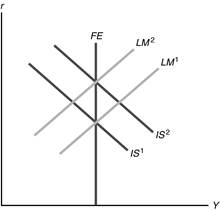

(b)

The rise in expected inflation shifts the LM curve down and to the

right, as shown in Figure 9.22. The price level rises, shifting the LM

curve up and to the left to restore equilibrium. Since the real interest rate is

unchanged, consumption and investment are unchanged. In summary, there is no

change in the real wage, employment, output, the real interest rate,

consumption, or investment; and there is a rise in the price level.

Figure 9.22

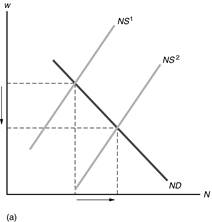

(c)

The increase in labor supply is shown as a shift in the labor supply

curve in Figure 9.23 (a).

This leads to a decline in the real wage rate and an increase in employment. The

rise in employment causes an increase in output, shifting the FE line to

the right in Figure 9.23 (b).

To restore equilibrium, the price level must decline, shifting the LM

curve down and to the right. Since output increases and the real interest rate

declines, consumption and investment increase.

In summary, the real wage, the real interest rate, and the price level decline;

and employment, output, consumption, and investment rise.

Figure 9.23

(d) The reduction in the demand for

money gives results identical to those in part (b).

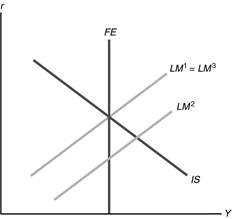

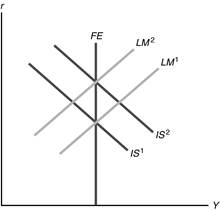

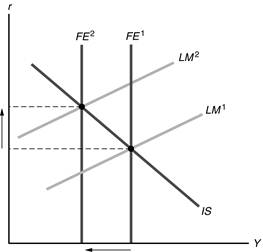

2.

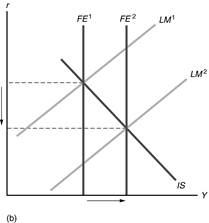

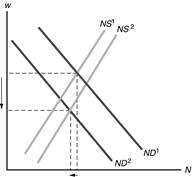

The increase in the price of oil reduces the marginal product of labor,

causing the labor demand curve to shift to

the left from ND1 to ND2 in Figure 9.24. The

answer key goes beyond what we did in class and states that since households’

expected future incomes decline, labor supply increases, shifting the

labor supply curve from NS1 to NS2 (but by

assumption, the shift to the left in labor demand is larger than the shift to

the right in labor supply). At equilibrium, there is a reduced real wage and

lower employment. The productivity shock results in a shift to the left of the

full-employment line from FE1 to FE2 in

Figure 9.25, as both employment and productivity decline. Because the shock is

permanent, it reduces future output and reduces the future marginal product of

capital, both of which result in a downward

shift of the IS curve. The new equilibrium is located at the

intersection of the new IS curve and the new FE line. If, as shown

in the figure, this intersection lies above and to the left of the original

LM curve, the price level will increase and shift the LM curve upward

(from LM1 to LM2) to pass through the new

equilibrium point. The result is an increase in the price level, but an

ambiguous effect on the real interest rate. Since output is lower, consumption

is lower. Since the effect on the real interest rate is ambiguous, the effect on

saving and investment are ambiguous as well, though the fall in the future

marginal product of capital would tend to reduce investment.

Figure 9.24

Figure 9.25

The result is different from that of a temporary supply shock; when the

shock is temporary there is no impact on future output or the marginal product

of capital, so the IS curve does not shift. In that case the price level

increases to shift the LM curve up and to the left from LM1

to LM2 in Figure 9.26 to restore equilibrium. In that case,

the real interest rate unambiguously increases. Under a permanent shock, the

IS curve shifts down and to the left, so the rise in the real interest rate

is less than in the case of a temporary shock, and the real interest rate can

even decline.

Figure 9.26