2.

A decline in productivity growth is the primary reason for the slowdown

in output growth in the United States since 1973. Productivity growth may have

declined because of deterioration in the legal and human environment, reduced

rates of technological innovation, and the effects of high oil prices. To some

extent the apparent decline in productivity may be due to measurement

difficulties.

3.

The rise in productivity growth in the 1990s occurred because of the

revolution in information and communications technologies (ICT). Not only were

there improvements in ICT, but also government regulations did not rein in the

growth of productivity in the United States, as they did in other countries,

such as those in Europe. In addition, intangible investment (research and

development, reorganization of firms, and worker training) allowed the ICT

improvements to boost productivity.

4.

A steady state is a situation in which the economy’s output per worker,

consumption per worker,

and capital stock per worker are constant.

5.

If there is no productivity growth, then output per worker, consumption

per worker, and capital per worker will all be constant in the long run. This

represents a steady state for the economy.

1. (a)

The destruction of some of a country’s capital stock in a war would have

no effect on the steady state, because there has been no change in s,

f, n, or d. Instead, k is reduced temporarily,

but equilibrium forces eventually drive k to the same steady-state value

as before.

(b)

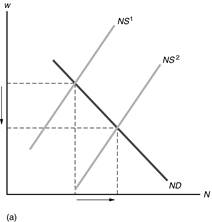

Immigration raises n from n1 to n2

in Figure 6.3. The rise in n lowers steady-state k,

leading to a lower steady-state consumption per worker.

Figure 6.3

(c)

The rise in energy prices reduces the productivity of capital per worker.

This causes sf(k) to shift down from sf1(k)

to sf2(k) in

Figure 6.4. The result is a decline in steady-state k. Steady-state

consumption per worker falls for two reasons: (1) Each unit of capital has a

lower productivity, and (2) steady-state k is reduced.

Figure 6.4

(d)

A temporary rise in s has no effect on the steady-state

equilibrium.

(e)

The increase in the size of the labor force does not affect the growth

rate of the labor force, so there is no impact on the steady-state capital-labor

ratio or on consumption per worker. However, because a larger fraction of

the population is working, consumption per person increases.

2. (a)

Solow model

The rise in

capital depreciation shifts up the (n +

d)k line from (n

+ d1)k to (n

+ d2)k,

as shown in Figure 6.5. The equilibrium steady-state capital-labor ratio

declines. With a lower capital-labor ratio, output per worker is lower, so

consumption per worker is lower (using the assumption that the capital-labor

ratio is not so high that an increase in k will reduce consumption per

worker). There is no effect on the long-run growth rate of the total capital

stock, because in the long run the capital stock must grow at the same rate (n)

as the labor force grows, so that the capital-labor ratio is constant.

Figure 6.5

(b)

Endogenous growth model

In an

endogenous growth model, the growth rate of output is

DY/Y

=

sA - d, so the

rise in the deprecia-tion rate reduces the economy’s growth rate. Similarly, the

growth rate of capital equals DK/K

=

sA - d, which also

declines when the depreciation rate rises. Since consumption is a constant

fraction of output, its growth rate declines as well. So the increase in the

depreciation rate reduces the long-run growth rate of the capital stock, as well

as long-run capital, output, and consumption per worker.

5.

The initial level of the capital-labor ratio is irrelevant for the steady

state. Two economies that are identical except for their initial capital-labor

ratios will have exactly the same steady state.

Since the two economies must have the same growth rate at the steady

state, and since the economy with the higher current capital-labor ratio has

higher current output per worker, then the country with the lower current

capital-labor ratio must grow faster.

The answer holds true regardless of which country is in a steady state.

If the country with a higher initial capital-labor ratio is in a steady state at

capital-labor ratio k*, then the other country’s capital-labor

ratio will rise until it too equals k*. So the country with

the lower capital-labor ratio grows faster than the one with the higher

capital-labor ratio.

If the country with the lower initial capital-labor ratio is in a steady

state at capital-labor ratio k*, then the other country’s

capital-labor ratio is too high and it will decline until it equals k*.

So the country with the higher capital-labor ratio must grow more slowly than

the country with the lower capital-labor ratio. If the two countries are allowed

to trade with each other, then their convergence to the same capital-labor ratio

and output per worker will occur even faster.

2.

|

|

20 Years Ago |

Today |

Percent

Change |

|

Y |

1000 |

1300 |

30% |

|

K |

2500 |

3250 |

30% |

|

N |

500 |

575 |

15% |

(a)

DA/A

= DY/Y

- aK

DK/K

- aN DN/N

= 30%

- (0.3

´ 30%)

- 0.7

´ 15%

= 30%

- 9% -

10.5%

= 10.5%

Capital

growth contributed 9% (aK DK/K),

labor growth contributed 10.5% (aN

DN/N), productivity growth was 10.5%.

(b)

DA/A

= 30% - (0.5

´

30%) - (0.5

´ 15%)

= 30%

- 15% -

7.5%

= 7.5%

Capital

growth contributed 15% (aK DK/K),

labor growth contributed 7.5% (aN

DN/N), productivity growth was 7.5%.

3. (a)

|

Year |

K |

N |

Y |

K/N |

Y/N |

|

1 |

200 |

1000 |

617 |

0.20 |

0.617 |

|

2 |

250 |

1000 |

660 |

0.25 |

0.660 |

|

3 |

250 |

1250 |

771 |

0.20 |

0.617 |

|

4 |

300 |

1200 |

792 |

0.25 |

0.660 |

This

production function can be written in per-worker form since Y/N

= K.3N.7/N

= K.3/N.3

=

(K/N).3. Note that K/N is the same in

years 1 and 3, and so is Y/N. Also, K/N is the same

in years 2 and 4, and so is Y/N.

(b)

|

Year |

K |

N |

Y |

K/N |

Y/N |

|

1 |

200 |

1000 |

1231 |

0.20 |

1.231 |

|

2 |

250 |

1000 |

1316 |

0.25 |

1.316 |

|

3 |

250 |

1250 |

1574 |

0.20 |

1.259 |

|

4 |

300 |

1200 |

1609 |

0.25 |

1.341 |

This

production function can’t be written in per-worker form since

Y/N

=

K.3N.8/N =

K.3/N.2.

Note that K/N is the same in years 1 and 3, but Y/N

is not the same in these years. The same is true for years 2 and 4.

4.

To answer this problem, an approximate solution can be found by finding

the ratio GDP (2006)/GDP (1950), taking the natural logarithm of that ratio and

dividing by 56. This is the answer given in the table below.

|

|

Real GDP Per Capital |

Growth |

|||

|

1950 |

2006 |

|

Ratio |

Rate |

|

|

Australia |

7,412 |

24,343 |

|

3.28 |

2.1% |

|

Canada |

7,291 |

24,951 |

|

3.42 |

2.2% |

|

France |

5,186 |

21,809 |

|

4.21 |

2.6% |

|

Germany |

3,881 |

19,993 |

|

5.15 |

2.9% |

|

Japan |

1,921 |

22,462 |

|

11.69 |

4.4% |

|

Sweden |

6,739 |

24,204 |

|

3.59 |

2.2% |

|

United Kingdom |

6,939 |

23,013 |

|

3.32 |

2.1% |

|

United States |

9,561 |

31,049 |

|

3.25 |

2.1% |

Germany and Japan had the highest growth rates because damage from World

War II caused capital per worker to be lower than its steady-state level, and

thus output per worker was temporarily low.

5. (a)

sf(k) = (n +

d)k

0.3

´ 3k.5

= (0.05

+ 0.1)k

0.9k.5

= 0.15k

0.9/0.15

= k/k.5

6

= k.5

k

= 62

= 36

y

= 3k.5

= 3

´

6 = 18

c

= y

- (n

+

d)k = 18

- (0.15

´

36) = 12.6

(b) sf(k)

= (n +

d)k

0.4

´ 3k.5

= (0.05

+ 0.1)k

1.2k.5

= 0.15k

1.2/0.15

= k/k.5

8

= k.5

k

= 82

= 64

y

= 3k.5

= 3

´

8 = 24

c

= y

- (n

+

d)k = 24

- (0.15

´

64) = 14.4

(c) sf(k)

= (n +

d)k

0.3

´ 3k.5

= (0.08 + 0.1)k

0.9k.5

= 0.18k

0.9/0.18

= k/k.5

5

= k.5

k

= 52

= 25

y

= 3k.5

= 3

´

5 = 15

c

= y – (n

+

d)k = 15 - (0.18

´

25) = 10.5

(d)

sf(k) = (n

+ d)k

0.3

´

4k.5 = (0.05

+ 0.1)k

1.2k.5

= 0.15k

1.2/0.15

= k/k.5

8

= k.5

k

= 82

= 64

y

= 4k.5

= 4

´ 8 = 32

c

= y – (n

+

d)k = 32

- (0.15

´

64) = 22.4