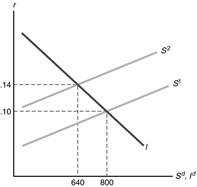

Figure 1

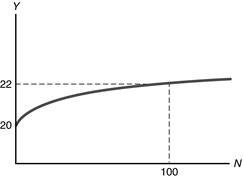

Figure 2

1.

(a)

Average labor productivity is output divided by employment:

2008: 12,000 tons of potatoes divided by 1000 workers

= 12 tons of potatoes per worker

2009: 14,300 tons of potatoes divided by 1100 workers

= 13 tons of potatoes per worker

(b) The growth rate of average labor

productivity is [(13/12) - 1]

´

100% = 8.33%.

(c) The unemployment rate is:

2008: (100 unemployed/1100

workers)

´

100% = 9.1%

2009: (50 unemployed/1150 workers)

´

100% = 4.3%

(d) The inflation rate is [(2.5/2)

- 1]

´

100% = 25%.

2.

Just because prices were lower in 1890 than they were in 2009 does not

mean that people were better off back then. People’s incomes have risen much

faster than prices have risen over the last 100 years, so they are better off

today in terms of real income.

3. Given data:

I =

40, G

= 30,

GNP

= 200, CA

= -20

=

NX

+ NFP,

T

=

60, TR

= 25,

INT

= 15, NFP

= 7 -

9 = -2.

Since GDP

=

GNP

- NFP,

GDP

= 200 - (-2)

= 202

= Y.

Since NX

+

NFP

= CA,

NX

= CA

-

NFP

= -20

- (-2)

= -18.

Since Y

=

C +

I +

G +

NX,

C =

Y -

(I

+ G

+

NX)

= 202 - (40

+ 30

+ (-18))

= 150.

Spvt

= (Y

+

NFP

-

T +

TR

+ INT)

-

C =

(202 + (-2)

- 60

+ 25 + 15)

-150

= 30. Sgovt

= (T

-

TR

- INT)

-

G =

(60 - 25

- 15)

- 30 =

-10.

S =

Spvt

+

Sgovt

= 30

+ (-10)

= 20.

(a) Consumption

= 150

(b)

Net exports =

-18

(c)

GDP =

202

(d) Net factor

payments from abroad =

-2

(e) Private

saving = 30

(f)

Government saving =

-10

(g) National

saving = 20

4.

|

Base-Year Quantities at Current-Year Prices |

|

At Base-Year Prices |

|

|

Apples |

3000

´ $3

= $

9,000 |

|

3000

´ $2

= $

6,000 |

|

Bananas |

6000

´ $2

=

$12,000 |

|

6000

´ $3

=

$18,000 |

|

Oranges |

8000

´ $5

=

$40,000 |

|

8000

´ $4

=

$32,000 |

|

Total |

$61,000 |

|

$56,000 |

|

Current-Year Quantities at Current-Year

Prices |

|

At Base-Year Prices |

|

|

Apples |

4,000

´ $3

= $

12,000 |

|

4,000

´ $2

= $

8,000 |

|

Bananas |

14,000

´ $2

= $

28,000 |

|

14,000

´ $3

= $

42,000 |

|

Oranges |

32,000

´ $5

=

$160,000 |

|

32,000

´ $4

=

$128,000 |

|

Total |

$200,000 |

|

$178,000 |

(a) Nominal GDP

is just the dollar value of production in a year at prices in that year. Nominal

GDP is $56 thousand in the base year and $200 thousand in the current year.

Nominal GDP grew 257% between the base year and the current year:

[($200,000/$56,000) - 1]

´

100% = 257%.

(b) Real GDP is

calculated by finding the value of production in each year at base-year prices.

Thus, from the table above, real GDP is

$56,000 in the base year and $178,000 in the current year. In percentage

terms, real GDP increases from the base year to the current year by

[($178,000/$56,000) - 1]

´

100% = 218%.

(c) The GDP

deflator is the ratio of nominal GDP to real GDP. In the base year, nominal GDP

equals real GDP, so the GDP deflator is 1. In the current year, the GDP deflator

is $200,000/$178,000 = 1.124. Thus the

GDP deflator changes by [(1.124/1) - 1]

´

100% = 12.4% from the base year to the

current year.

(d) Nominal GDP

rose 257%, prices rose 12.4%, and real GDP rose 218%, so most of the increase

in nominal GDP is because of the increase in real output, not prices. Notice

that the quantity of oranges quadrupled and the quantity of bananas more than

doubled.

5. The key to this

question is that real GDP is not the same thing as well-being. People may be

better off even if real GDP is lower; for example, this may occur because the

improvement in the health of workers is more valuable to society than the loss

of GDP due to the regulation. Ideally, we would like to be able to compare the

costs and benefits of such regulations; they should be put in place if the

overall costs (the reduced GDP in this case) are valued less than the overall

benefits (the workers’ health).

6. (a)

The problem in a planned economy is that prices do not measure market

value. When the price

of an item is too low, then goods are really more expensive than their listed

price suggests—we should include in their market value the value of time spent

by consumers waiting to make purchases. Because the item’s value exceeds its

cost, measured GDP is too low.

When the price of an item is too high, goods stocked on the shelves may

be valued too highly. This results in an overvaluation of firms’ inventories, so

that measured GDP is too high.

A possible strategy for dealing with

this problem is to have GDP analysts estimate what the market price

should be (perhaps by looking at prices of the same goods in market economies)

and use this “shadow” price in the GDP calculations.

(b) The goods

and services that people produce at home are not counted in the GDP figures

because they are not sold on the market, making their value difficult to

measure. One way to do it might be to look at the standard of living relative to

a market economy, and estimate what income it would take in a market economy to

support that standard of living.

7.

(a)

|

N |

Y |

MPN |

MRPN

(P

=

5) |

MRPN

(P

=

10) |

|

1 |

8 |

8 |

40 |

80 |

|

2 |

15 |

7 |

35 |

70 |

|

3 |

21 |

6 |

30 |

60 |

|

4 |

26 |

5 |

25 |

50 |

|

5 |

30 |

4 |

20 |

40 |

|

6 |

33 |

3 |

15 |

30 |

(b)

P =

$5.

(1) W

= $38. Hire one worker, since MRPN

($40) is greater than W ($38) at N

= 1. Do not hire two workers, since

MRPN ($35) is less than W ($38) at N

= 2.

(2) W

= $27. Hire three workers, since

MRPN ($30) is greater than W ($27) at N

= 3. Do not hire four workers, since

MRPN ($25) is less than W ($27) at N

= 4.

(3) W

= $22. Hire four workers, since MRPN

($25) is greater than W ($22) at N

= 4. Do not hire five workers, since

MRPN ($20) is less than W ($22) at N

= 5.

(c) Figure 1

plots the relationship between labor demand and the nominal wage. This graph is

different from a real labor demand curve because a labor demand curve shows the

relationship between labor demand and the real wage. Figure 2 shows the real

labor demand curve.

|

Figure 1 |

Figure 2 |

(d)

P =

$10. The table in part a shows the MRPN

for each N. At

W =

$38, the firm should hire five workers.

MRPN ($40) is greater than W

($38) at N

= 5. The firm shouldn’t hire six

workers, since MRPN ($30) is less

than W ($38) at

N =

6. With five workers, output is 30 widgets, compared to 8 widgets in part a when

the firm hired only one worker. So the increase in the price of the product

increases the firm’s labor demand and output.

(e) If output

doubles, MPN doubles, so

MRPN doubles. The

MRPN is the same as it was in part d

when the price doubled. So labor demand is the same as it was in part d. But the

output produced by five workers now doubles to 60 widgets.

(f) Since

MRPN

=

P

´

MPN,

then a doubling of either P or

MPN leads to a doubling of

MRPN. Since labor demand is chosen by

setting MRPN equal to

W,

the choice is the same, whether

P doubles or

MPN doubles.