1. In a small open economy,

Desired national saving,

Sd = $10 billion + ($100 billion)rw:

Desired investment, Id

= $15 billion – ($100 billion)rw;

Output, Y = $50 billion;

Government purchases, G = $10

billion;

World real interest rate, rw

= 0.03.

a.

Find the economy’s national saving, investment,

current account surplus, net exports, desired consumption, and absorption.

All variables but interest rates are in billions of dollars.

(a) S

= 10

+ (100

´

0.03) = 13

![]()

A

= C

+ I

+ G

= 27 + 12

+ 10

= 49

b.

Owing to a technological innovation, the

country’s desired investment rises by $2 billion at each level of the world real

interest rate. Repeat part (a).

(b) S

= 13, as before.

![]()

![]()

![]()

Desired consumption, Cd = 320 + .4(Y-T) -200rw;

Desired investment, Id = 150 – 200rw;

Output, Y = 1000;

Taxes, T = 200;

Government purchases, G = 275

In the foreign country the following relationships hold:

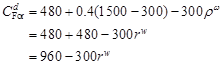

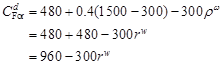

Desired consumption, CdFor = 480 + 0.4(YFor-TFor)

– 300rw;

Desired investment, IdFor = 225-300rw;

Output, YFor = 1500;

Taxes, TFor = 300;

Government purchases, GFor = 300.

a.

What is the equilibrium interest rate in the

international capital market? What are the equilibrium values of consumption,

national saving, investment, and the current account balance in each country?

(a) To find the equilibrium

interest rate (rw), we must first calculate the current

account for each country as a function of rw. Then we can find

the value of rw that clears the goods market, that is, where

CA + CAFor

= 0.

Home:

Cd

= 320

+ 0.4(1000 - 200)

- 200rw

= 320 + 320

- 200 rw

= 640 - 200 rw

CA

= NX

= Sd – Id

= Y – (Cd

+ Id

+ G)

= 1000 – (640 – 200 rw

+ 150 – 200rw

+ 275)

= –65 + 400 rw

Foreign:

CAFor

= NXFor

= SdFor

- IdFor

= YFor

-

(CdFor

+ IdFor

+ GFor)

= 1500 - (960

- 300rw

+ 225

- 300rw + 300)

= 15 + 600 rw

At

equilibrium, CA + CAFor

= 0, so:

–65

+ 400 rw

+ 15

+ 600 rw = 0

–50

+ 1000 rw

= 0

rw

= 0.05

C

= 640

- 200 rw = 630

CFor

= 960

- 300 rw = 945

S

= Y

- C

- G

= 1000

- 630

- 275 = 95

SFor

= YFor

- CFor

- GFor

= 1500

- 945

- 300 = 255

I

= 150

- 200 rw = 140

IFor

= 225

- 300 rw = 210

CA

= S

- I

= 95

- 140 =

-45

CAFor

= SFor

- IFor

= 255

- 210 = 45

b.

Suppose that in the home country government

purchases increase by 50 to 325. Taxes also increase by 50 to keep the deficit

from growing. What is the new equilibrium interest rate in the international

capital market? What are the new equilibrium values of consumption, national

saving, investment, and the current account balance in each country?

(b) Cd

= 320

+ 0.4(1000 - 250)

- 200 rw

= 320 + 300

- 200 rw

= 620 - 200 rw

CA

= NX

= Sd

- Id

= Y

- (Cd

+ Id

+ G)

= 1000 - (620

- 200 rw

+ 150

- 200 rw +

325)

= -95

+ 400 rw

At

equilibrium, CA + CAFor

= 0, so:

-95 +

400 rw + 15

+ 600 rw

= 0

-80 +

1000 rw = 0

rw

= 0.08

C

= 620

- 200 rw = 604

CFor

= 960

- 300 rw = 936

S

= Y

- C

- G

= 1000

- 604

- 325 = 71

SFor

= YFor

- CFor

- GFor

= 1500

- 936

- 300 = 264

I

= 150

- 200 rw = 134

IFor

= 225

- 300 rw = 201

CA

= S

- I

= 71

- 134 =

-63

CAFor

= SFor

- IFor

= 264

- 201 = 63

So a

balanced-budget increase in government spending increases the home country’s

current account deficit.

3.

Explain how each of the following transactions

would enter the U.S. balance of payments accounts. Discuss only the transactions

described. Do not be concerned with the possible offsetting transactions.

a.

The U.S. government sells

F-16 fighter planes to a foreign government.

b.

A London bank sells yen to, and buys dollars

from, a Swiss bank.

c.

The Federal Reserve sells yen to, and buys

dollars from, a Swiss bank.

d.

A New York bank receives the interest on its

loans to Brazil.

e.

A U.S. collector buys some ancient artifacts from

a collection in Egypt.

f.

A U.S. oil company buys insurance from Lloyds of

London to insure its oil rigs in the Gulf of Mexico.

g.

A U.S. company borrows from a British bank

(a) Export of merchandise:

credit entry in current account.

(b)

No entry: just changes the type of foreigner holding U.S. assets.

(c)

Decrease in U.S. official reserve assets: credit entry in capital and

financial account.

(d)

Income receipt from abroad: credit entry in current account.

(e)

Import of assets: debit entry in capital and financial account.

(f)

Import of services: debit entry in current account.

(g)

Increase in foreign ownership of U.S. assets: credit entry in capital and

financial account.