1. Hula hoop fabricators cost $100 each. The Hi-Ho hula Hoop Company is trying

to decide how many of these machines to buy. HHHHC expects to produce the

following numbers of hoops each year for each level of capital stock shown.

Number

of Fabricators Number

of Hoops

Produced per Year

0 0

1 100

2 150

3 180

4 195

5 205

6 210

Hula hoops have a real value of $1 each. HHHHC has no other costs besides the

cost of fabricators.

a. Find

the expected future marginal product of capital (in terms of dollars) for each

level of capital. The MPKf for

the third fabricator, for example, is the real value of the extra output

obtained when the third fabricator is added

(a) This chart shows the

MPKf as the increase in

output from adding another fabricator:

|

#

Fabricators |

Output |

MPKf |

|

0 |

0 |

— |

|

1 |

100 |

100 |

|

2 |

150 |

50 |

|

3 |

180 |

30 |

|

4 |

195 |

15 |

|

5 |

205 |

10 |

|

6 |

210 |

5 |

b. If

the real interest rate is 12% per year and the depreciation rate of capital is

20% per year, find the user cost of capital (in dollars per fabricator per

year). How many fabricators should HHHHC buy?

(b)

uc

= (r

+

d)pK

= (0.12

+ 0.20)$100

= $32.

HHHHC should buy two fabricators,

since at two fabricators, MPKf

= 50

> 32 =

uc. But at three fabricators,

MPKf

= 30

< 32 =

uc. You want to add fabricators only

if the future marginal product of capital exceeds the user cost of capital. The

MPKf

of the third fabricator is less than its user cost, so it should not be added.

c. Repeat

Part (b) for a real interest rate of 8% per year

(c)

When r

= 0.08,

uc

= (0.08 + 0.20)$100

= $28. Now they should buy three

fabricators, since

MPKf

=

30 >

28

=

uc

for the third fabricator and MPKf

=

15

<

28

=

uc

for the fourth fabricator.

d. Repeat

Part (b) for a 40% tax on HHHHC’s sales revenues.

(d)

With taxes, they should add additional fabricators as long as (1

-

t)MPKf

>

uc. Since

t

= 0.4, 1

-

t

= 0.6. They should buy just one

fabricator, since (1 -

t)MPKf

= 0.6

´

100 = 60

> 32

= uc. They shouldn’t buy two,

since then (1 -

τ)MPKf

= 0.6

´

50 = 30

< 32

= uc.

e. A

technical innovation doubles the number of hoops a fabricator can produce. How

many fabricators should HHHHC buy when the real interest rate is 12% per year?

8% per year? Assume that there are no taxes and that the depreciation rate is

still 20% per year.

(e)

When output doubles, the MPKf

doubles as well. At r

= 0.12, they should buy three

fabricators, since then MPKf

= 60

> 32 =

uc; they shouldn’t buy four, since

then MPKf

= 30

< 32 =

uc.

At

r =

0.08, they should buy four fabricators, since then

MPKf

= 30

> 28 =

uc; they shouldn’t buy five, since

then MPKf

= 20

< 28 =

uc.

2. An economy has full-employment output of 6000. Government purchases, G, are

1200. Desired consumptions and desired investment are

Cd =3600

– 2000r + 0.10Y, and

Id =

1200 – 4000r,

Where Y is output and r is the real interest rate.

a. Find

an equation relating desired national saving, Sd, to r and Y

(a)

Sd

=

Y -

Cd

-

G

=

Y -

(3600 - 2000r

+ 0.1Y)

- 1200

= -4800

+ 2000r

+ 0.9Y

b. Using

both versions of the goods market equilibrium conditions, Eqs. (4.7) and (4.8),

find the real interest rate that clears the good market. Assume that output

equals full-employment output.

(b)

(1) Using Eq. (4.7): Y

=

Cd

+

Id

+

G

Y =

(3600 - 2000r

+ 0.1Y)

+ (1200

- 4000r)

+ 1200

= 6000

- 6000r

+ 0.1Y

So 0.9Y

= 6000

- 6000r

At full employment, Y = 6000.

Solving 0.9

´

6000 = 6000

- 6000r, we get r

= 0.10.

(2) Using

Eq. (4.8):

Sd =

Id

-4800

+

2000r

+

0.9Y

=

1200 -

4000r

0.9Y

=

6000 -

6000r

When Y

=

6000, r =

0.10.

So we can use either Eq. (4.7) or (4.8) to get to the same result.

c. Government

purchases rise to 1440. How does this increase change the equation describing

desired national saving? Show the change graphically. What happens to the

market-clearing real interest rate?

(c) When

G =

1440, desired saving becomes Sd

=

Y -

Cd

-

G =

Y -

(3600 - 2000r

+ 0.1Y)

- 1440

= -5040

+ 2000r

+ 0.9Y.

Sd is now 240 less

for any given r and

Y; this shows up as a shift in the

Sd line from

S1 to

S2 in the Figure

Figure

Setting Sd = Id,

we get:

-5040

+ 2000r

+ 0.9Y

= 1200

- 4000r

6000r

+ 0.9Y

= 6240

At Y

= 6000, this is 6000r

= 6240

- (0.9

´

6000) = 840, so r

= 0.14. The market-clearing real

interest rate increases from 10% to 14%.

3. Suppose that the economywide expected future marginal product of capital is

MPKf = 20 – 0.02K,

where K is the future capital stock. The depreciation rate of capital, d,

is 20% per period. The current capital stock is 900 units of capital. The price

of a unit of capital is 1 unit of output. Firms pay taxes equal to 50% of their

output. The consumption function in the economy is C= 100 + 0.5Y-200r, where C

is consumption, Y is output, and r is the real interest rate. Government

purchases equal 200, and full-employment output is 1000.

a.

suppose that the real interest rate is 10% per period. What are the values of

the tax-adjusted user cost of capital, the desired future capital stock, and the

desired level of investment?

(a)

r =

0.10

uc/(1

-

τ)

= (r

+

d)pK/(1

-

t)

= [(.1

+ 0.2)

´

1]/(1 - 0.15)

= 0.35.

MPKf

=

uc/(1

-

t),

so 20 - 0.02K

= 0.35; solving this gives

K

= 982.5.

Since

K

-

K-1

=

I

-

dK, I

=

K -

K-1

+

dK = 982.5

- 900

+ (.2

´

900) = 262.5.

b. Now

consider the real interest rate determined by goods market equilibrium. This

part of the problem will guide you to this interest rate.

i.

Write the tax-adjusted user cost of capital as a function of the real interest

rate r. also write the desired future capital stock and desired investment as

functions of r.

ii.

Use the investment function derived in Part (i) along with the consumption

function and government purchases, to calculate the real interest rate that

clears the goods market. What are the goods market-clearing values of

consumption, saving, and investment? What are the tax-adjusted user cost of

capital and the desired capital stock in this equilibrium?

(b) i.

Solving for this in general:

uc/(1

-

t)

= (r

+

d)pK/(1

-

τ)

= [(r

+

.2)

´

1]/(1 - 0.15)

= .235

+ 1.176r.

MPKf

=

uc/(1

-

t),

so 20 - 0.02K

= 0.235

+ 1.176r;

solving this gives

K

= 988.25

- 58.8r.

I =

K -

K-1

+

dK = 988.25

- 58.8r

- 900

+ (0.2

´

900) = 268.25

- 58.8r.

ii. Y

= C

+ I

+ G

1000 = [100

+ (.5

´

1000) - 200r]

+ (268.25

- 58.8r)

+ 200

1000 = 1068.25

- 258.8r,

so 258.8r

= 68.25

r =

0.264

C =

100 + (0.5

´

1000) - (200 × 0.264) = 547.2

I = 268.25

- (58.8 × 0.264) = 252.7 =

S

uc/(1

-

t)

= 0.235 + (1.176

´

0.264) = 0.545

K

= 988.25 - (58.8 × 0.264) = 972.7

4. Use the

saving-investment diagram to analyze the effects of the following on national

saving, investment, and the real interest rate. Explain your reasoning.

a. Consumers

become more future-oriented and thus decide to save more.

b. The

government announces a large, one-time bonus payment to veterans returning from

a war. The bonus will be financed by additional taxes levied on the general

population over the next five years.

c. The

government introduces an investment tax credit (offset by other types of taxes,

so total tax collections remain unchanged).

d. A

large number of accessible oil deposits are discovered, which increases the

expected future marginal product of oil rigs and pipelines. It also causes an

increases in expected future income.

The

increase in expected future income decreases current desired saving, as people

increase desired consumption immediately. The rise of the future marginal

productivity of capital shifts the investment curve to the right. The result, as

shown in Figure, is that the real interest rate rises, with ambiguous effects on

saving and investment.

5. A country loses much

of its capital stock to a war.

e. What

effects should this event have on the country’s current employment, output, and

real wage?

f. What

effect will the loss of capital have on desired investment

Because the capital stock is lower, the marginal product of capital will be

higher, so desired investment will increase.

g. The

effects of desired national saving of the wartime losses are ambiguous. Give one

reason for desired saving to rise and one reason for it to fall.

(c)

Since current output declines, desired saving declines, because people do

not want to reduce their consumption. On the other hand, since future output is

also lower, people desire to save more today to make up for the loss of future

income.

h. Assume

that desired saving doesn’t change. What effect does the loss of capital have on

the country’s real interest rate and the quantity of investment?

6. In a small open

economy, output (gross domestic product) is $25 billion, government purchases

are $6 billion, and net factor payments from abroad are zero. Desired

consumption and desired investment are related to the world real interest rate

in the following manner:

World Real Interest Rate Desired

Consumption Desired

Investment

5% $12

billion $3

billion

4% $13

billion $4

billion

3% $14

billion $5

billion

2% $15

billion $6

billion

For each

value of the world real interest rate, find national saving, foreign lending,

and absorption. Calculate net exports as the difference between output and

absorption. What is the relationship between net exports and foreign lending?

The following table calculates key variables for this question for different

values of the real interest rate. The column for S is calculated by the

equation S = Y

- (Cd

+ G). The column headed S

- I is foreign lending.

Absorption (A) is Cd

+ Id + G.

Net exports (NX) are output (Y) minus absorption (A). Every

column except r consists of dollar amounts in billions.

|

r |

Cd |

Id |

S |

S -

I |

A |

NX |

|

5% |

12 |

3 |

7 |

4 |

21 |

4 |

|

4% |

13 |

4 |

6 |

2 |

23 |

2 |

|

3% |

14 |

5 |

5 |

0 |

25 |

0 |

|

2% |

15 |

6 |

4 |

–2 |

27 |

–2 |

Net exports and foreign lending are identical.

3. All variables

but interest rates are in billions of dollars.

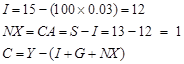

(a) S

= 10

+ (100

´

0.03) = 13

![]()

A

= C

+ I

+ G

=

27 + 12

+ 10

=

49

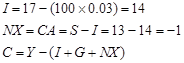

(b) S

= 13, as before.

![]()

![]()

![]()