1. Hula hoop fabricators cost $100 each. The Hi-Ho hula Hoop Company is trying

to decide how many of these machines to buy. HHHHC expects to produce the

following numbers of hoops each year for each level of capital stock shown.

Number

of Fabricators Number

of Hoops

Produced per Year

0 0

1 100

2 150

3 180

4 195

5 205

6 210

Hula hoops have a real value of $1 each. HHHHC has no other costs besides the

cost of fabricators.

a. Find

the expected future marginal product of capital (in terms of dollars) for each

level of capital. The MPKf for

the third fabricator, for example, is the real value of the extra output

obtained when the third fabricator is added

(a) This chart shows the

MPKf as the increase in

output from adding another fabricator:

|

#

Fabricators |

Output |

MPKf |

|

0 |

0 |

— |

|

1 |

100 |

100 |

|

2 |

150 |

50 |

|

3 |

180 |

30 |

|

4 |

195 |

15 |

|

5 |

205 |

10 |

|

6 |

210 |

5 |

b. If

the real interest rate is 12% per year and the depreciation rate of capital is

20% per year, find the user cost of capital (in dollars per fabricator per

year). How many fabricators should HHHHC buy?

(b)

uc

= (r

+

d)pK

= (0.12

+ 0.20)$100

= $32.

HHHHC should buy two fabricators,

since at two fabricators, MPKf

= 50

> 32 =

uc. But at three fabricators,

MPKf

= 30

< 32 =

uc. You want to add fabricators only

if the future marginal product of capital exceeds the user cost of capital. The

MPKf

of the third fabricator is less than its user cost, so it should not be added.

c. Repeat

Part (b) for a real interest rate of 8% per year

(c)

When r

= 0.08,

uc

= (0.08 + 0.20)$100

= $28. Now they should buy three

fabricators, since

MPKf

=

30 >

28

=

uc

for the third fabricator and MPKf

=

15

<

28

=

uc

for the fourth fabricator.

d. Repeat

Part (b) for a 40% tax on HHHHC’s sales revenues.

(d)

With taxes, they should add additional fabricators as long as (1

-

t)MPKf

>

uc. Since

t

= 0.4, 1

-

t

= 0.6. They should buy just one

fabricator, since (1 -

t)MPKf

= 0.6

´

100 = 60

> 32

= uc. They shouldn’t buy two,

since then (1 -

τ)MPKf

= 0.6

´

50 = 30

< 32

= uc.

e. A

technical innovation doubles the number of hoops a fabricator can produce. How

many fabricators should HHHHC buy when the real interest rate is 12% per year?

8% per year? Assume that there are no taxes and that the depreciation rate is

still 20% per year.

(e)

When output doubles, the MPKf

doubles as well. At r

= 0.12, they should buy three

fabricators, since then MPKf

= 60

> 32 =

uc; they shouldn’t buy four, since

then MPKf

= 30

< 32 =

uc.

At

r =

0.08, they should buy four fabricators, since then

MPKf

= 30

> 28 =

uc; they shouldn’t buy five, since

then MPKf

= 20

< 28 =

uc.

2. An economy has full-employment output of 6000. Government purchases, G, are

1200. Desired consumptions and desired investment are

Cd =3600

– 2000r + 0.10Y, and

Id =

1200 – 4000r,

Where Y is output and r is the real interest rate.

a. Find

an equation relating desired national saving, Sd, to r and Y

(a)

Sd

=

Y -

Cd

-

G

=

Y -

(3600 - 2000r

+ 0.1Y)

- 1200

= -4800

+ 2000r

+ 0.9Y

b. Using

both versions of the goods market equilibrium conditions, Eqs. (4.7) and (4.8),

find the real interest rate that clears the good market. Assume that output

equals full-employment output.

(b)

(1) Using Eq. (4.7): Y

=

Cd

+

Id

+

G

Y =

(3600 - 2000r

+ 0.1Y)

+ (1200

- 4000r)

+ 1200

= 6000

- 6000r

+ 0.1Y

So 0.9Y

= 6000

- 6000r

At full employment, Y = 6000.

Solving 0.9

´

6000 = 6000

- 6000r, we get r

= 0.10.

(2) Using

Eq. (4.8):

Sd =

Id

-4800

+

2000r

+

0.9Y

=

1200 -

4000r

0.9Y

=

6000 -

6000r

When Y

=

6000, r =

0.10.

So we can use either Eq. (4.7) or (4.8) to get to the same result.

c. Government

purchases rise to 1440. How does this increase change the equation describing

desired national saving? Show the change graphically. What happens to the

market-clearing real interest rate?

(c) When

G =

1440, desired saving becomes Sd

=

Y -

Cd

-

G =

Y -

(3600 - 2000r

+ 0.1Y)

- 1440

= -5040

+ 2000r

+ 0.9Y.

Sd is now 240 less

for any given r and

Y; this shows up as a shift in the

Sd line from

S1 to

S2 in the Figure

Figure

Setting Sd = Id,

we get:

-5040

+ 2000r

+ 0.9Y

= 1200

- 4000r

6000r

+ 0.9Y

= 6240

At Y

= 6000, this is 6000r

= 6240

- (0.9

´

6000) = 840, so r

= 0.14. The market-clearing real

interest rate increases from 10% to 14%.

3. Suppose that the economywide expected future marginal product of capital is

MPKf = 20 – 0.02K,

where K is the future capital stock. The depreciation rate of capital, d,

is 20% per period. The current capital stock is 900 units of capital. The price

of a unit of capital is 1 unit of output. Firms pay taxes equal to 50% of their

output. The consumption function in the economy is C= 100 + 0.5Y-200r, where C

is consumption, Y is output, and r is the real interest rate. Government

purchases equal 200, and full-employment output is 1000.

a.

suppose that the real interest rate is 10% per period. What are the values of

the tax-adjusted user cost of capital, the desired future capital stock, and the

desired level of investment?

Some were confused about this problem. The issue is that in this answer the tax rate is 15% as compared to 50% as stated in the problem. I will let you walk through the problem to prove this to yourself. It is much too difficult for a 50 min exam, but the process is useful to walk through.

(a)

r =

0.10

uc/(1

-

τ)

= (r

+

d)pK/(1

-

t)

= [(.1

+ 0.2)

´

1]/(1 - 0.15)

= 0.35.

MPKf

=

uc/(1

-

t),

so 20 - 0.02K

= 0.35; solving this gives

K

= 982.5.

Since

K

-

K-1

=

I

-

dK, I

=

K -

K-1

+

dK = 982.5

- 900

+ (.2

´

900) = 262.5.

b. Now

consider the real interest rate determined by goods market equilibrium. This

part of the problem will guide you to this interest rate.

i.

Write the tax-adjusted user cost of capital as a function of the real interest

rate r. also write the desired future capital stock and desired investment as

functions of r.

ii.

Use the investment function derived in Part (i) along with the consumption

function and government purchases, to calculate the real interest rate that

clears the goods market. What are the goods market-clearing values of

consumption, saving, and investment? What are the tax-adjusted user cost of

capital and the desired capital stock in this equilibrium?

(b) i.

Solving for this in general:

uc/(1

-

t)

= (r

+

d)pK/(1

-

τ)

= [(r

+

.2)

´

1]/(1 - 0.15)

= .235

+ 1.176r.

MPKf

=

uc/(1

-

t),

so 20 - 0.02K

= 0.235

+ 1.176r;

solving this gives

K

= 988.25

- 58.8r.

I =

K -

K-1

+

dK = 988.25

- 58.8r

- 900

+ (0.2

´

900) = 268.25

- 58.8r.

ii. Y

= C

+ I

+ G

1000 = [100

+ (.5

´

1000) - 200r]

+ (268.25

- 58.8r)

+ 200

1000 = 1068.25

- 258.8r,

so 258.8r

= 68.25

r =

0.264

C =

100 + (0.5

´

1000) - (200 × 0.264) = 547.2

I = 268.25

- (58.8 × 0.264) = 252.7 =

S

uc/(1

-

t)

= 0.235 + (1.176

´

0.264) = 0.545

K

= 988.25 - (58.8 × 0.264) = 972.7

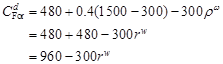

(a) To find the equilibrium

interest rate (rw), we must first calculate the current

account for each country as a function of rw. Then we can find

the value of rw that clears the goods market, that is, where

CA + CAFor

= 0.

Home:

Cd

= 320

+ 0.4(1000 - 200)

- 200rw

= 320 + 320

- 200 rw

= 640 - 200 rw

CA

= NX

= Sd – Id

= Y – (Cd

+ Id

+ G)

= 1000 – (640 – 200 rw

+ 150 – 200rw

+ 275)

= –65 + 400 rw

Foreign:

CAFor

= NXFor

= SdFor

- IdFor

= YFor

-

(CdFor

+ IdFor

+ GFor)

= 1500 - (960

- 300rw

+ 225

- 300rw + 300)

= 15 + 600 rw

At

equilibrium, CA + CAFor

= 0, so:

–65

+ 400 rw

+ 15

+ 600 rw = 0

–50

+ 1000 rw

= 0

rw

= 0.05

C

= 640

- 200 rw = 630

CFor

= 960

- 300 rw = 945

S

= Y

- C

- G

= 1000

- 630

- 275 = 95

SFor

= YFor

- CFor

- GFor

= 1500

- 945

- 300 = 255

I

= 150

- 200 rw = 140

IFor

= 225

- 300 rw = 210

CA

= S

- I

= 95

- 140 =

-45

CAFor

= SFor

- IFor

= 255

- 210 = 45

(b) Cd

= 320

+ 0.4(1000 - 250)

- 200 rw

= 320 + 300

- 200 rw

= 620 - 200 rw

CA

= NX

= Sd

- Id

= Y

- (Cd

+ Id

+ G)

= 1000 - (620

- 200 rw

+ 150

- 200 rw +

325)

= -95

+ 400 rw

At

equilibrium, CA + CAFor

= 0, so:

-95 +

400 rw + 15

+ 600 rw

= 0

-80 +

1000 rw = 0

rw

= 0.08

C

= 620

- 200 rw = 604

CFor

= 960

- 300 rw = 936

S

= Y

- C

- G

= 1000

- 604

- 325 = 71

SFor

= YFor

- CFor

- GFor

= 1500

- 936

- 300 = 264

I

= 150

- 200 rw = 134

IFor

= 225

- 300 rw = 201

CA

= S

- I

= 71

- 134 =

-63

CAFor

= SFor

- IFor

= 264

- 201 = 63

So a

balanced-budget increase in government spending increases the home country’s

current account deficit.

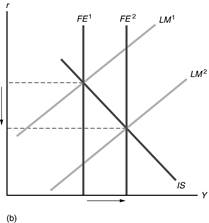

(a) The home country’s saving

curve shifts to the right, from S1 to S2 in

Figure 5.5. The real world interest rate falls, so that the current account

surplus in the home country equals the current account deficit in the foreign

country. From Figure 5.5, S rises, I rises, CA rises, rw

falls.

Figure 5.5

(b)

The foreign country’s saving curve shifts to the right, from

![]() to

to

![]() in Figure 5.6. The real world interest rate must fall, so the

current account surplus in the foreign country equals the current account

deficit in the home country. As shown in the figure, S falls, I

rises, CA falls,

in Figure 5.6. The real world interest rate must fall, so the

current account surplus in the foreign country equals the current account

deficit in the home country. As shown in the figure, S falls, I

rises, CA falls,

rw falls.

Figure 5.6

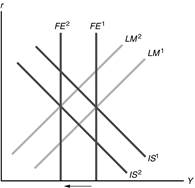

(c)

The foreign country’s saving curve shifts to the left, from

![]() to

to

![]() in Figure 5.7. The real world interest rate must rise, so the

current account deficit in the foreign country equals the current account

surplus in the home country. As shown in the figure, S rises, I

falls, CA rises,

in Figure 5.7. The real world interest rate must rise, so the

current account deficit in the foreign country equals the current account

surplus in the home country. As shown in the figure, S rises, I

falls, CA rises,

rw rises.

Figure 5.7

(d)

If Ricardian equivalence holds, there is no effect. If Ricardian

equivalence does not hold, then

the result is the same as in part (b), as the foreign country’s saving curve

shifts to the right.