1. Let us explore

the Cobb-Douglas production function introduced in class.

Although not explicitly stated, the growth equation listed in 6.1—The

Sources of Growth is this Cobb-Douglas format.

Let us look at an economy over twenty years.

Its total output has grown from 6,501 to 12,679, its capital stock has

risen from 22,033 to 38,440, and its labor force has increased from .107 to

.143. All measurements are in real

terms. Calculate the contributions

to economic growth of growth in capital, labor, and productivity:

a. Assuming that α= 0.3 and β = 0.7.

b. Assuming that α= 0.5 and β=

0.5.

DA/A = DY/Y - aK DK/K - aN DN/N

This is 49.14% in part a and 40.98% in part b.

2. For a particular economy, the following

capital input K and labor input N were reported in four different

years:

|

K |

N |

Y | K/N | Y/N | |

|

1 |

49.3 |

.154 |

.869 | 320.13 | 5.64 |

|

2 |

50.0 |

.155 |

.877 | 322.58 | 5.66 |

|

3 |

50.6 |

.155 |

.880 | 326.45 | 5.72 |

|

4 |

51.2 |

.156 |

.887 | 328.21 | 5.69 |

|

|

|

|

The production

function in this economy is

Y = K.3N.7

where Y is total output.

a. Find total output, the capital-labor

ratio, and output per worker in each year. Compare year 1 with year 3 and year 2

with year 4. Can this production

function be written in per-worker form?

If so, write algebraically the per-worker form of the production

function.

b. Repeat Part (a) but assume now that the

production function is Y = K.3N.8

|

K |

N |

Y | K/N | Y/N | |

|

1 |

49.3 |

.154 |

.721 | 320.13 | 4.681 |

|

2 |

50.0 |

.155 |

.728 | 322.58 | 4.69 |

|

3 |

50.6 |

.155 |

.739 | 326.45 | 4.71 |

|

4 |

51.2 |

.156 |

.737 | 328.21 | 3.72 |

|

|

|

|

3. An economy has the per-worker

production function

yt = 3k0.5

where is

output per worker and is the capital-labor ratio. The depreciation rate is 0.08,

and the population growth rate is 0.04. Saving is

St = 0.1Yt where is

total national saving and is total output.

a. What are the steady-state values of the

capital-labor ratio, output per worker, and consumption per worker?

sf(k) = (n

+

d)k

0.1

´

3k.5 = (0.08

+ 0.04)k

0.3k.5

= 0.12k

0.3/0.12

= k/k.5

2.5

= k.5

k = 62 = 6.25

y = 3k.5 = 7.5

c = y - (n + d)k = 6.75

The rest of the problem shows the effects of changes in the three

fundamental determinants of long-run living standards.

b. Repeat Part (a) for a saving rate of

0.12 instead of 0.1.

sf(k) = (n

+

d)k

0.12

´

3k.5 = (0.08

+ 0.04)k

3

= k.5

k = 32 = 9

y = 3k.5 = 9

c = y - (n + d)k = 7.92

c. Repeat Part (a) for a population growth

rate of 0.06 (with a saving rate of 0.1).

sf(k) = (n

+

d)k

0.1

´

3k.5 = (0.08

+ 0.06)k

2.1428

= k.5

k = 4.59

y = 6.429

c = y - (n + d)k = 5.786

d. Repeat Part (a) for a production function of yt = 4k0.5

Assume that the

saving rate and population growth rate are at their original values.

sf(k) = (n

+

d)k

0.1

´

4k.5 = (0.08

+ 0.04)k

k = 11.11

y = 13.33

c = y - (n + d)k = 12

4. According to our growth model, how

would each of the following affect output per worker, investment per worker,

consumption per worker, and the capital to labor ratio in the long run (that is,

in the steady state)? Illustrate

with a graph!

a. A

hurricane destroys

a portion of

the nation’s capital stock.

The destruction of some of a country’s capital stock would have no effect on the

final steady state, because there has been no change in s,

f, n, or d. Instead, k is reduced temporarily,

but equilibrium forces eventually drive k to the same steady-state value

as before.

b. Congress

decides to allow anyone to migrate to the United States.

As most of the new population has a higher birth rate compared to the

current population, the overall population growth rate

increases.

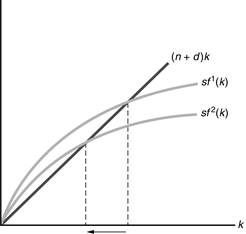

Immigration raises n from n1 to n2 .

The rise in n lowers steady-state k,

leading to a lower steady-state consumption per worker.

c. Congress

requires all states increase the use non-fossil fuel energy to help protect the

environment. This causes an increase

in

energy prices.

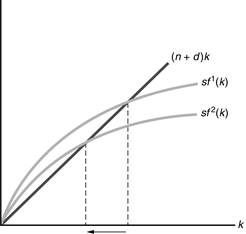

The rise in energy prices reduces the productivity of capital per worker. This causes both the per-capital production function and sf(k) to shift down. The graph below only illustrates the per-capita investment shift to show the decline in steady-state k. All factors will be reduced. When you graph this be sure to include the shift of both curves. I did not have a beautiful pre-made graph so I substituted with this partial , but neat, graph.

d. Americans become increasing anxious

about global warming and increase their saving (a rise in the saving rate) to

provide some protection from future problems.

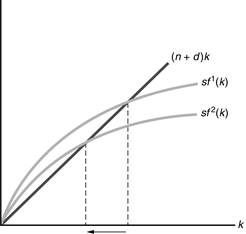

The changes will look like the graph above, but will not have a change in the per-capita production function. We know that k and y will increase, but c is dependent upon the golden rule.

e. Psychologists

argue that children need greater parental support to have a well-adjusted

childhood. This cause a large number

of two-income families to switch to a single-income family with a stay-at-home

parent. This will cause a permanent decrease in the fraction of

the population in the labor force (the population growth rate is unchanged).

The increase in the size of the labor force does not affect the growth rate of

the labor force, so there is no impact on the steady-state capital-labor ratio

or on consumption per worker. However, our model has limitations.

5. An economy has a per-capita production

function y = Akαh1-α, where A and a are

fixed parameters, y is per-worker output, k is the capital-labor

ratio, and h is human capital per worker, a measure of the skills and

raining of the average worker. The production function implies that, for a given

capital-labor ratio, increases in average human capital raise output per worker.

The economy’s saving rate is s, and all saving is used to

create physical capital, which depreciates at rate d. Workers acquire

skills on the job by working with capital; the more capital with which they have

to work, the more skills they acquire.

We capture this idea by assuming that human capital per worker is always

proportional to the amount of physical capital per worker, or h = Bk,

where B is a fixed parameter.

Find the long-run growth rates of physical capital, human

capital, and output in the economy.

Assume there are a constant number of workers, N, so that Ny

=

Y and Nk = K. Since

y = Akah1–a

and

h =

Bk, then y

=

Aka(Bk)1–a

= (AB1–a)k.

Then Y = Ny

= (AB1–a)K

=

XK, where X equals AB1–a. This puts the

production function in notation used in the chapter.

Investment is DK

+ dK

= sY = national

saving. Dividing through both sides of that expression by K and using the

production function gives DK/K

+ d = sXK/K

= sX, so DK/K

= sX

- d,

which is the long-run growth rate of physical capital. Since output and

human capital are proportional to physical capital, they will all grow at that

same rate.