I cheated and used the key, but we have a final next week. You will be expected to do all of these examples in the 3 graph framework, the AD/AS model, and in IS/LM. These are good problems to practice.

4. (a)

A temporary increase in government purchases reduces national saving,

causing the real interest rate to rise for a fixed level of income. If the real

interest rate is higher, then real money demand will be lower. So prices must

rise to make money supply equal money demand. The result is that output is

unchanged, the real interest rate increases, and the price level increases.

(b) When expected inflation falls,

real money demand increases. With no effect on employment or saving and

investment, output and the real interest rate remain unchanged. With higher real

money demand and an unchanged nominal money supply, the equilibrium price level

must decline. So output and the real interest rate are unchanged and prices

decline.

(c) When labor supply rises,

full-employment output increases. Also, with higher output, saving will

increase, so the real interest rate will decline. Both higher output and a lower

real interest rate increase real money demand. The price level must decline to

equate money supply with money demand. The result is an increase in output and a

decrease in both the real interest rate and the price level.

(d) When the interest rate paid on

money increases, real money demand rises. With no effect on employment or saving

and investment, output and the real interest rate remain unchanged. With higher

real money demand and an unchanged nominal money supply, the equilibrium price

level must decline. So output and the real interest rate are unchanged and

prices decline.

8. Keynesians and

classicals differ sharply in their beliefs about how long it takes the economy

to reach a long-run equilibrium. Classical economists believe that prices adjust

rapidly (within a few months) to restore equilibrium in the face of a shock,

while Keynesians believe that prices adjust slowly, taking perhaps several

years.

Because of the time it takes for the economy’s equilibrium to be restored,

Keynesians see an important role for the government in fighting recessions. But

because classicals believe that equilibrium is restored quickly, there’s no need

for government policy to fight recessions.

Since classicals think equilibrium is restored quickly in the face of shocks,

aggregate demand shocks can’t cause recessions, since they can’t affect output

for very long. So classical economists think recessions are caused by aggregate

supply shocks. Keynesians, however, think that both aggregate demand and

aggregate supply shocks are capable of causing recessions.

Below is not the problem you completed, but rather the IS/LM version. Take some time and compare your answers to these and what you would obtain in AD/AS/

3.

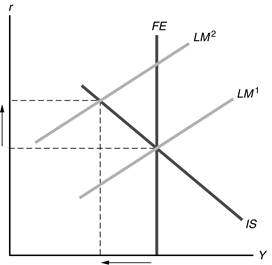

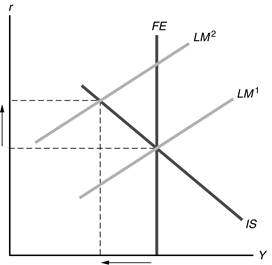

(a) The decrease in expected

inflation increases real money demand, shifting the LM curve up, as shown

in Figure 9.27. The real interest rate rises and output declines.

Figure 9.27

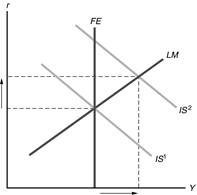

(b) The increase in desired

consumption shifts the IS curve up and to the right, as shown in

Figure 9.28. This causes the real interest rate and output to rise.

Figure 9.28

(c) The increase in government

purchases shifts the IS curve up and to the right, with the same result

as in part (b). (The FE line also

shifts, as the increase in government expenditures reduces people’s wealth and

leads them to increase labor supply, but this shift will not affect the

short-run equilibrium, as the economy will be off the

FE line.)

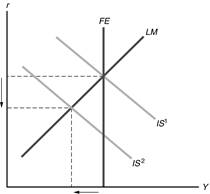

(d) If Ricardian

equivalence holds, the increase in taxes has no effect on either the IS

or LM curves, so there is no change in either the real interest rate or

output. If Ricardian equivalence doesn’t hold, so that the increase in taxes

reduces consumption spending, the IS curve shifts down and to the left,

as shown in Figure 9.29. Both the real interest rate and output decline.

Figure 9.29

(e) An increase in the expected

future marginal productivity of capital shifts the IS curve up and to the

right, with the same result as in part (b).