1.

(a) More, because the bonds have become more

liquid; (b) more, because their expected return has risen relative to

stocks; (c) less, because they have become less liquid relative to stocks; (d)

less, because their expected return has fallen; (e) more, because they have

become more liquid.

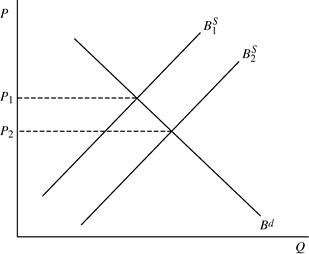

2. When

the Fed sells bonds to the public, it increases the supply of bonds, thus

shifting the supply curve

Bs

to the right. The result is that the intersection of the supply and demand

curves Bs

and Bd

occurs at a lower price and a higher equilibrium interest rate, and the

interest rate rises. With the liquidity preference framework, the decrease in

the money supply shifts the money supply curve

Ms

to the left, and the equilibrium interest

rate rises. The answer from bond supply and demand analysis is consistent

with the answer from the liquidity preference framework.

3. When

the price level rises, the quantity of money in real terms falls (holding the

nominal supply of money constant); to

restore their holdings of money in real terms to their former level, people will

want to hold a greater nominal quantity of money. Thus the money demand

curve Md shifts to the

right, and the interest rate rises.

5.

Interest rates would rise. A sudden increase in people’s expectations of

future real estate prices raises the expected return on real estate relative to

bonds, so the demand for bonds falls. The demand curve

Bd shifts to the left,

bond prices fall, and the equilibrium interest rate rises.

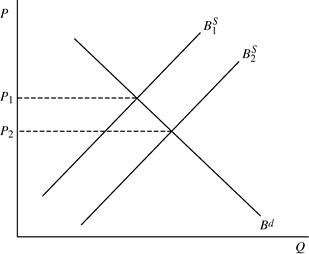

6. Interest rates should rise. The large federal

deficits require the Treasury to issue more bonds; thus the

supply of bonds increases. The supply curve,

Bs, shifts to the right and the equilibrium interest rate

rises. Some economists believe that when the Treasury issues more bonds,

the demand for bonds increases because the issue of bonds increases the public’s

wealth. If this is the case, the demand curve, Bd, will also

shift to the right, and it is no longer clear that the equilibrium interest rate

will rise. Thus there is some potential ambiguity in the answer to this

question.

7.

Given the answer to Question 10

above, the supply effect of large deficits should lead to higher interest

rates. The effects of the economic crisis

lead to significantly lower wealth and income, which depressed Treasury

bond demand, but also decreased corporate bond supply by even more because

investment opportunities collapsed. The larger leftward shift in the bond supply

curve than the rightward shift in the bond

demand curve would then result in a rise in bond prices and a fall in interest

rates. In addition, due to the severity of the global crisis, U.S.

treasury debt became a safe haven investment, reducing

relative risk and increasing liquidity for

U.S. treasury debt. This significantly raised U.S. treasury bond demand,

leading to higher bond prices and significantly lower yields. In other words,

the decrease in investment opportunities and risk factors significantly offset

the wealth effect on demand and the deficit effect on supply.

8.

Yes, interest rates will rise. The lower commission on stocks makes them

more liquid relative to bonds, and the demand for bonds will fall. The demand

curve Bd will therefore

shift to the left, and the equilibrium interest rate will rise.

9.

U.S. treasury bills have lower default risk and more liquidity than negotiable

CDs. Consequently, the demand for Treasury bills is higher, and they have a

lower interest rate.

10. During

business cycle booms, fewer corporations go bankrupt and there is less default

risk on corporate bonds, which lowers

their risk premium. Conversely, during recessions default risk on corporate

bonds increases and their risk premium increases. The risk premium on

corporate bonds is thus anticyclical, rising during recessions and falling

during booms.

11. True. When bonds of different maturities are

close substitutes, a rise in interest rates for one bond

causes the interest rates for others to rise

because the expected returns on bonds of different maturities cannot get

too far out of line.