Chapter 1

KEY POINTS:

·

The fundamental

lessons about individual decision-making are that people face trade-offs among

alternative goals, that the cost of any action is measured in terms of forgone

opportunities, that rational people make decisions by comparing marginal costs

and marginal benefits, and that people change their behavior in response to the

incentives they face.

· The fundamental lessons about interactions among people are that trade and interdependence can be mutually beneficial, that markets are usually a good way of coordinating economic activity among people, and that the government can potentially improve market outcomes by remedying a market failure or by promoting greater economic equality.

· The fundamental lessons about the economy as a whole are that productivity is the ultimate source of living standards, that growth in the quantity of money is the ultimate source of inflation, and that society faces a short-run trade-off between inflation and unemployment.

The word “economy” comes from the Greek word oikonomos meaning “one who manages a household.”

This makes some sense because in the economy we are faced with many decisions (just as a household is).

Fundamental economic problem: resources are scarce.

Know the definition of

scarcity.

Know the definition of

economics.

II. How People Make Decisions

A. Principle #1: People Face Trade-offs

What does it mean when we say, “There ain’t no such thing as a free lunch.”

Be able to give some examples of tradeoffs.

Understand the special example of a trade-off is the trade-off between efficiency and equality.

What is the definition of efficiency.

What is the definition of

equality.

B. Principle #2: The Cost of Something Is What You Give Up to Get It

Making decisions requires individuals to consider the benefits and costs of some action.

What are the costs of going to college?

What is the definition of

opportunity cost.

C. Principle #3: Rational People Think at the Margin

What is the definition of rational.

Consumers want to purchase the goods and services that allow them the greatest level of satisfaction given their incomes and the prices they face.

Firm managers want to produce the level of output that maximizes the profits the firms earn.

Many decisions in life involve incremental decisions: Should I remain in school this semester? Should I take another course this semester? Should I study another hour for tomorrow’s exam? This is an example of what economic concept?

D. Principle #4: People Respond to Incentives

What is an incentive.

Because rational people make decisions by weighing costs and benefits, their decisions may change in response to incentives.

a. When the price of a good rises, consumers will buy less of it because its cost has risen.

b. When the price of a good rises, producers will allocate more resources to the production of the good because the benefit from producing the good has risen.

How People Interact

A. Principle #5: Trade Can Make Everyone Better Off

Trade is not like a sports contest, where one side gains and the other side loses.

Consider trade that takes place inside your home. Your family is likely to be involved in trade with other families on a daily basis. Most families do not build their own homes, make their own clothes, or grow their own food.

Countries benefit from trading with one another as well.

Trade allows for specialization in products that countries (or families) can do best.

B. Principle #6: Markets Are Usually a Good Way to Organize Economic Activity

What is the definition of

market economy.

Market prices reflect both the value of a product to consumers and the cost of the resources used to produce it.

C. Principle #7: Governments Can Sometimes Improve Market Outcomes

The invisible hand will only work if the government enforces property rights.

Definition of property rights: the ability of an individual to own and exercise control over scarce resources.

There are two broad reasons for the government to interfere with the economy: the promotion of efficiency and equality.

Government policy can be most useful when there is market failure and the economy is inefficient.

Definition of market failure: a situation in which a market left on its own fails to allocate resources efficiently. This is because the price does not adjust, or it adjusts slowly, or it adjusts to the wrong price.

Examples of Market Failure

What is an

externality.

What is market power.

Because a market economy rewards people for their ability to produce things that other people are willing to pay for, there will be an unequal distribution of economic well-being.

IV. How the Economy as a Whole Works

A. Principle #8: A Country’s Standard of Living Depends on Its Ability to Produce Goods and Services

Differences in living standards from one country to another are quite large.

Changes in living standards over time are also great.

The explanation for differences in living standards lies in differences in productivity.

B. Principle #9: Prices Rise When the Government Prints Too Much Money

1. Definition of inflation: an increase in the overall level of prices in the economy.

Chapter 2

KEY POINTS:

·

Economists try to address their

subject with a scientist’s objectivity. Like all scientists, they make

appropriate assumptions and build simplified models in order to understand the

world around them. Two simple economic models are the circular-flow diagram and

the production possibilities frontier.

·

The field of economics is divided

into two subfields: microeconomics and macroeconomics. Microeconomists study

decision-making by households and firms and the interaction among households and

firms in the marketplace. Macroeconomists study the forces and trends that

affect the economy as a whole.

·

A positive statement is an

assertion about how the world is. A

normative statement is an assertion about how the world

ought to be. When economists make

normative statements, they are acting more as policy advisers than scientists.

·

Economists who advise policymakers

offer conflicting advice either because of differences in scientific judgments

or because of differences in values. At other times, economists are united in

the advice they offer, but policymakers may choose to ignore it.

A. Economists Follow the Scientific Method.

1. Observations help us to develop questions.

2. We can hypothesize about the questions.

3. Using data, we can evaluate our hypotheses.

B. Assumptions Make the World Easier to Understand.

C. Economists Use Economic Models to Explain the World Around Us.

1. Most economic models are composed of diagrams and equations.

2. The goal of a model is to simplify reality in order to increase our understanding. This is where the use of assumptions is helpful.

D. Our First Model: The Circular Flow Diagram

![]()

Definition of circular-flow diagram: a visual model of the economy that shows how dollars flow through markets among households and firms.

This diagram is a very simple model of the economy. Note that it ignores the roles of government and international trade, but we made a more complex diagram in class

Our Second Model: The Production Possibilities Frontier

Definition of

production possibilities frontier: a graph that shows the combinations of

output that the economy can possibly produce given the available factors of

production and the available production technology.

Be able to explain what is occurring at each of the points.

The production possibilities frontier reveals Principle #1: People face tradeoffs.

Principle #2 is also shown on the production possibilities frontier: The cost of something is what you give up to get it (opportunity cost).

Economists generally believe that production possibilities frontiers often have this bowed-out shape because some resources are better suited to the production of cars than computers (and vice versa).

The production possibilities frontier can shift if resource availability or technology changes. Economic growth can be illustrated by an outward shift of the production possibilities frontier.

Microeconomics and Macroeconomics

Economics is studied on various levels.

Definition of

microeconomics: the study of how households and firms make decisions and how

they interact in markets.

Definition of

macroeconomics: the study of economy-wide phenomena, including inflation,

unemployment, and economic growth.

Chapter 3

KEY POINTS:

· Each person consumes goods and services produced by many other people both in our country and around the world. Interdependence and trade are desirable because they allow everyone to enjoy a greater quantity and variety of goods and services.

· There are two ways to compare the ability of two people in producing a good. The person who can produce the good with a smaller quantity of inputs is said to have an absolute advantage in producing the good. The person who has the smaller opportunity cost of producing the good is said to have a comparative advantage. The gains from trade are based on comparative advantage, not absolute advantage.

· Trade makes everyone better off because it allows people to specialize in those activities in which they have a comparative advantage.

· The principle of comparative advantage applies to countries as well as people. Economists use the principle of comparative advantage to advocate free trade among countries.

A Parable for the Modern Economy

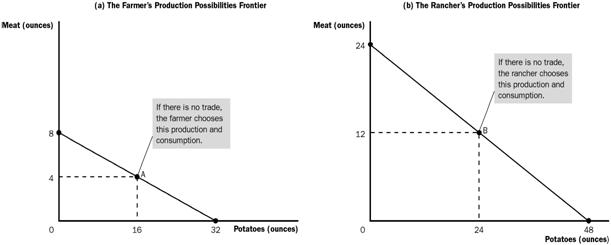

Example: two goods—meat and potatoes; and two people—a cattle rancher and a potato farmer (each of whom likes to consume both potatoes and meat).

The gains from trade are obvious if the farmer can only grow potatoes and the rancher can only raise cattle.

The gains from trade are also obvious if, instead, the farmer can raise cattle as well as grow potatoes, but he is not as good at it and the rancher can grow potatoes in addition to raising cattle, but her land is not well suited for it.

The gains from trade are not as clear if either the farmer or the rancher is better at producing both potatoes and meat.

B. Production Possibilities ***Notice that the scales are different!!!!!!*****

C. Specialization and Trade

II. Comparative Advantage: The Driving Force of Specialization

Definition of absolute advantage.

The rancher has an absolute advantage in the production of both potatoes and meat.

Definition of opportunity cost.

Definition of comparative advantage.

The farmer has a lower opportunity cost of producing potatoes and therefore has a comparative advantage in the production of potatoes.

The rancher has a lower opportunity cost of producing meat and therefore has a comparative advantage in the production of meat.

Remember the scales are different. It might be a good idea to redraw the graphs carefully.

It is impossible for a person to have a comparative advantage in the production of both goods.

Trade

Give up the good that you have a comparative advantage at so that you may get the good that you do not have a comparative advantage at.

B. Should the United States Trade with Other Countries?

Just as individuals can benefit from specialization and trade, so can the populations of different countries.

Definition of imports.

Definition of exports.

The principle of comparative advantage suggests that each good should be produced by the country with a comparative advantage in producing that good (smaller opportunity cost).

Through specialization and trade, countries can have more of all goods to consume.

Trade issues among nations are more complex. Some individuals can be made worse off even when the country as a whole is made better off.

Chapter 4

KEY POINTS:

· Economists use the model of supply and demand to analyze competitive markets. In a competitive market, there are many buyers and sellers, each of whom has little or no influence on the market price.

· The demand curve shows how the quantity of a good demanded depends on the price. According to the law of demand, as the price of a good falls, the quantity demanded rises. Therefore, the demand curve slopes downward.

· In addition to price, other determinants of how much consumers want to buy include income, the prices of substitutes and complements, tastes, expectations, and the number of buyers. If one of these factors changes, the demand curve shifts.

· The supply curve shows how the quantity of a good supplied depends on the price. According to the law of supply, as the price of a good rises, the quantity supplied rises. Therefore, the supply curve slopes upward.

· In addition to price, other determinants of how much producers want to sell include input prices, technology, expectations, and the number of sellers. If one of these factors changes, the supply curve shifts.

· The intersection of the supply and demand curves determines the market equilibrium. At the equilibrium price, the quantity demanded equals the quantity supplied.

· The behavior of buyers and sellers naturally drives markets toward their equilibrium. When the market price is above the equilibrium price, there is a surplus of the good, which causes the market price to fall. When the market price is below the equilibrium price, there is a shortage, which causes the market price to rise.

· To analyze how any event influences a market, we use the supply-and-demand diagram to examine how the event affects equilibrium price and quantity. To do this we follow three steps. First, we decide whether the event shifts the supply curve or the demand curve (or both). Second, we decide which direction the curve shifts. Third, we compare the new equilibrium with the initial equilibrium.

· In market economies, prices are the signals that guide economic decisions and thereby allocate scarce resources. For every good in the economy, the price ensures that supply and demand are in balance. The equilibrium price then determines how much of the good buyers choose to consume and how much sellers choose to produce.

What Is a Market?

What Is Competition?

What are the characteristics of a perfectly competitive market:

Demand

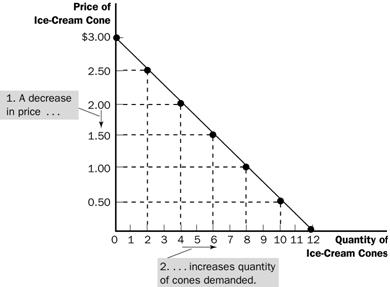

The Demand Curve: The Relationship between Price and Quantity Demanded

Definition of quantity demanded: the amount of a good that buyers are willing and able to purchase.

Definition of law of demand: the claim that, other things being equal, the quantity demanded of a good falls when the price of the good rises.

Demand schedule

|

Price of Ice Cream Cone |

Quantity of Cones Demanded |

|

|

$0.00 |

12 |

|

|

$0.50 |

10 |

|

|

$1.00 |

8 |

|

|

$1.50 |

6 |

|

|

$2.00 |

4 |

|

|

$2.50 |

2 |

|

|

$3.00 |

0 |

|

Shifts in the Demand Curve

Income

Definition of normal good.

Definition of

inferior good.

Prices of Related Goods

Definition of substitutes.

Definition of complements.

Tastes

Expectations

Number of Buyers

*****I hope to do supply, but I may need to wait until after the test*******

III. Supply

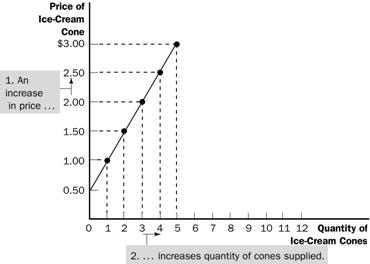

A. The Supply Curve: The Relationship between Price and Quantity Supplied

Definition of quantity supplied: the amount of a good that sellers are willing and able to sell.

Quantity supplied is positively related to price. This implies that the supply curve will be upward sloping.

Definition of law of

supply: the claim that, other things equal, the quantity supplied of a good

rises when the price of the good rises.

|

Price of Ice Cream Cone |

Quantity of Cones Supplied |

|

$0.00 |

0 |

|

$0.50 |

0 |

|

$1.00 |

1 |

|

$1.50 |

2 |

|

$2.00 |

3 |

|

$2.50 |

4 |

|

$3.00 |

5 |

![]()

Shifts in the Supply Curve

Input Prices

Technology

Expectations

Number of Sellers

IV. Supply and Demand Together

Equilibrium

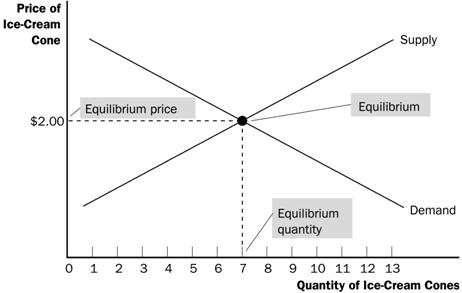

The point where the supply and demand curves intersect is called the market’s equilibrium.

Definition of equilibrium: a situation in which the market price has reached the level at which quantity supplied equals quantity demanded.

Definition of equilibrium price: the price that balances quantity supplied and quantity demanded.

Definition of

equilibrium quantity: the quantity supplied and the quantity demanded at the

equilibrium price.

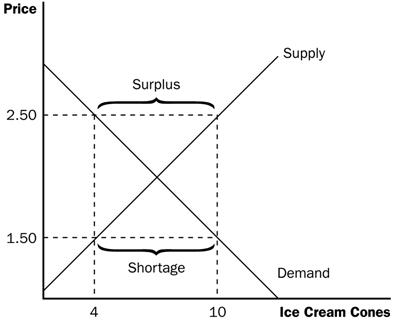

If the actual market price is higher than the equilibrium price, there will be a surplus of the good.

If the actual price is lower than the equilibrium price, there will be a shortage of the good.

B. Three Steps to Analyzing Changes in Equilibrium

1. Decide whether the event shifts the supply or demand curve .

2. Determine the direction in which the curve shifts.

3. Use the supply-and-demand diagram to see how the shift changes the equilibrium price and quantity.